I'm tying to reconcile the delta value for an FX option. I'm comparing the results to Bloomberg to verify our calculation is correct.

I've looked at this - Quantlib: Greeks of FX option in Python but it doesn't show where Rd (domestic interest rate) Rf (foreign interest rate) came from.

The option I'm trying to calculate the Delta for is as follows:

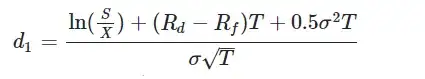

The Black-Scholes formula for delta is as follows:

where:

Using the information for the ScreenShot I get:

S = 108.947

X = 83.200

T = 83 / 365 = 0.2274 years

σ = 15.703% = 15.703 / 100 = 0.15703

Where can I find the Rd (domestic interest rate) Rf (foreign interest rate) from the screen shot? Do I need to access this from another screen in Bloomberg?