The assertion that the answer to this question is "yes" was made in an answer to another question here: Which solar power technology has the highest energy return on investment (EROI aka EROEI)?.

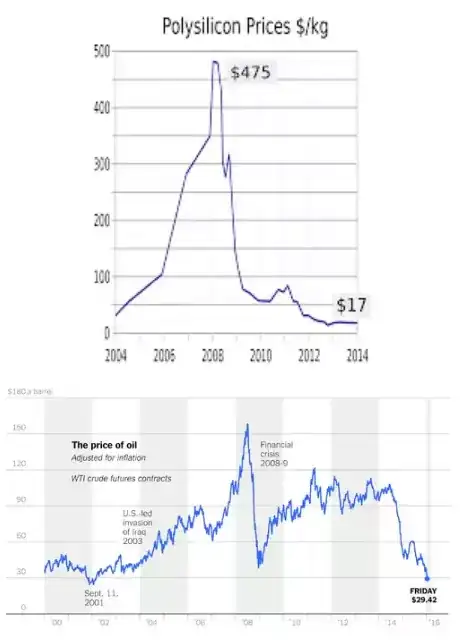

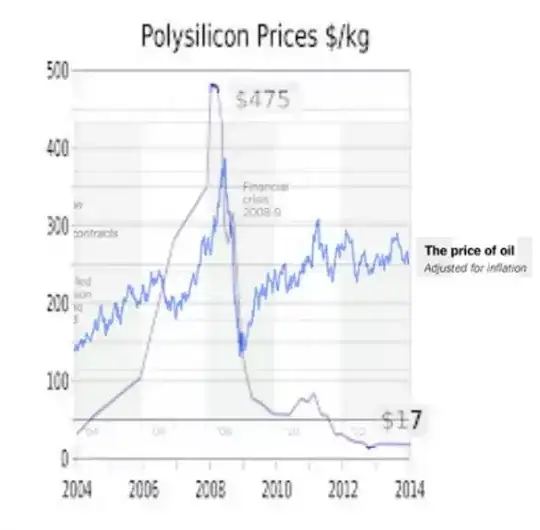

The user (@DJSims/@NeilTyson/@Mustang) posted these two graphics as evidence:

Note that the poster did not provide a source for either chart, however a quick google image search indicates that they are likely indicative of actual trends.

Now, a quick glance at these charts does indicate that the prices seem to track. However, the most striking feature is the boom leading to 2008, and the bust thereafter. I am not an economist, but I suspect that historical pricing for any two randomly selected commodities (with the possible exception of gold) would look pretty similar in the years immediately before and after 2008.

So, do oil and polysilicon prices actually depend on each other? Are these charts sufficient to decide one way or another? Or is more information needed? Is there enough data post-2008 to decide if the trend would continue?