I took the residual of a historical stock price $\hat e_t=r_t-\hat \mu_t$, where $r_t$ is the return of a stock and ran ACF and PACF. From the ACF I think that the residual does not follow AR or MA process, and the PACF shows slight MA. But I am new to this and I am not sure if my interpretation is correct.

What do you think?

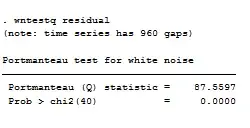

The Ljung Box test gave Q-statistic of 87.5597

which rejects the null that the autocorrelation coefficients are all zero. I used 40 lags here to be consistent with the ACF and PACF.

Does this contradict or confirm your intuition from visually inspecting ACF and PACF?