I have been learning time-series forecasting recently and I am trying to understand the procedure. I would like to find the best model for a daily time series, so far I tried exponential smoothing with ets and also ARIMA with auto.arima, but when I pass both models to Ljung-Box test, they both fail. I would like to know how I could improve the forecast here since I am relatively new and have many questions as I would like to learn more and dive deeper into this field. For example I am familiar with improving the forecast of linear models with AR models where we apply an ARIMA model on the residuals and improve it. But about ets and ARIMA models I am not sure.

Here are the results:

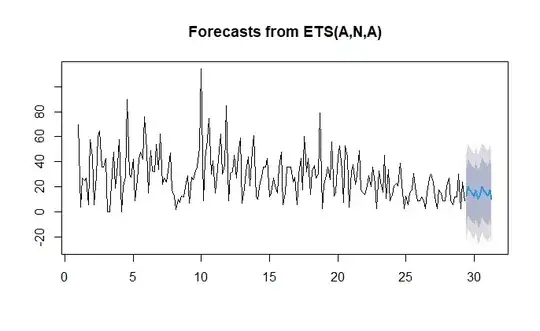

# The forecast for 14 days ahead

auto.arima(ts_d) %>%

forecast(h = 14) %>%

autoplot()

and also the result of Ljung-Box test:

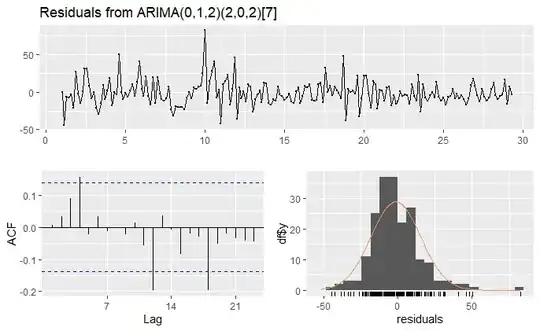

checkresiduals(auto.arima(ts_d))

Ljung-Box test

data: Residuals from ARIMA(0,1,2)(2,0,2)[7]

Q* = 16.683, df = 8, p-value = 0.03358

Model df: 6. Total lags used: 14

The result of exponential smoothing model:

ets(ts_d) %>%

forecast() %>%

plot()

And also the result of Ljung-Box test for exponential smoothing:

checkresiduals(ets(ts_d))

Ljung-Box test

data: Residuals from ETS(A,N,A)

Q* = 21.076, df = 5, p-value = 0.0007837

Model df: 9. Total lags used: 14

One more thing I don't understand is why I got an error message as follows when I apply a log transformation on my ARIMA model:

Error in auto.arima(ts_d, lambda = 0) : No suitable ARIMA model found In addition: Warning message: The chosen seasonal unit root test encountered an error when testing for the first difference. From stl(): NA/NaN/Inf in foreign function call (arg 1) 0 seasonal differences will be used. Consider using a different unit root test.

Here I also add a reproducible version of my ts:

structure(c(70, 4, 27, 25, 27, 6, 58, 44, 6, 29, 60, 65, 36,

36, 43, 0, 0, 22, 48, 19, 38, 58, 0, 20, 28, 90, 30, 28, 42,

9, 26, 42, 48, 42, 76, 49, 15, 49, 33, 32, 54, 34, 62, 22, 27,

24, 33, 47, 18, 13, 2, 10, 8, 13, 12, 20, 29, 7, 28, 26, 33,

36, 51, 114, 9, 42, 57, 75, 30, 41, 15, 28, 49, 62, 30, 37, 85,

9, 31, 32, 45, 27, 45, 59, 7, 19, 32, 44, 21, 49, 61, 12, 10,

24, 28, 36, 36, 43, 12, 15, 27, 21, 15, 35, 48, 6, 15, 36, 36,

36, 24, 28, 6, 30, 43, 18, 60, 32, 43, 14, 33, 37, 27, 30, 79,

3, 22, 29, 36, 26, 56, 13, 16, 44, 53, 34, 8, 53, 44, 4, 32,

38, 22, 29, 49, 18, 15, 14, 21, 29, 20, 36, 23, 3, 33, 24, 16,

45, 11, 34, 9, 14, 21, 23, 21, 39, 22, 3, 13, 6, 15, 18, 31,

15, 9, 9, 12, 9, 3, 15, 27, 30, 24, 12, 3, 18, 15, 9, 9, 21,

27, 9, 6, 12, 12, 30, 3, 24, 9), .Tsp = c(1, 29.2857142857143,

7), class = "ts")

Thank you very much in advance for your time and please forgive me if my question seems so basic as I am quite naive in the field but very eager to improve.

code. Also, see "Testing for autocorrelation: Ljung-Box versus Breusch-Godfrey". – Richard Hardy Nov 27 '21 at 12:40p,dandqparameters. I would like to ask would it be weird if I could use a model likeArima(ts_d2, order = c(20, 2, 2), lambda = 0.3)for example with apof20so that all residuals become independent with p-value also greater than 0.05? – Anoushiravan R Nov 28 '21 at 12:42auto.arimafor model selection, as that model selection algorithm is tuned specifically with forecast accuracy in mind. – Richard Hardy Nov 28 '21 at 13:39auto.arimato get anARIMA(0,1,1)and myp.valueis now0.4505andAICcis around61.05with only one lag outside the blue dotted lines in ACF diagram. – Anoushiravan R Nov 29 '21 at 00:05p.valueif we have only one or two lags outside the blue dotted lines, does it mean that our model fitted the data quite well? which one actually defines the situation better? Thank you very much for your time and all of the valuable advice. I am leaning all this material for a month but I plan on going on and try to understand more. It takes time a bit. – Anoushiravan R Nov 29 '21 at 00:08Arimamodels? Because in this case I didn't do that. However, fore evaluatingAccuracyit could be. – Anoushiravan R Nov 29 '21 at 10:18