TL;DR: Non-seasonal ARIMA models with sufficiently high order can indeed pick up seasonal signals quite easily, especially for short seasonal periods. The main risk lies in overfitting.

Let's compare two very simple models. Your data is trended, so you difference once; we will use no integration. We will also dispense with the MA component in the interest of simplicity.

- The simplest seasonal ARIMA model for quarterly data is an $\text{AR}(0)(1)_4$, which we can write using the backshift operator $B$ as

$$ (1-\Phi_1B^4)y_t = \epsilon_t $$

or

$$ y_t = \Phi_1 y_{t-4}+\epsilon_t. $$

- Let's compare this to an $\text{AR}(4)$ model, where of course I am picking the order 4 so it has a chance of picking up the seasonal dynamics:

$$ (1-\phi_1B-\dots-\phi_4B^4)y_t = \epsilon_t $$

or

$$ y_t = \phi_1y_{t-1}+\dots+\phi_4y_{t-4}+\epsilon_t. $$

Now, comparing our two models, we see that the $\text{AR}(4)$ model encompasses the $\text{AR}(0)(1)_4$ one: they both have an $y_{t-4}$ term, but the $\text{AR}(4)$ model also contains $y_{t-1}$, $y_{t-2}$ and $y_{t-3}$ ones.

Thus, we would expect the $\text{AR}(4)$ model to do at least as good a job in fitting as the $\text{AR}(0)(1)_4$ model. The difference may show up in the forecasts: since the $\text{AR}(4)$ model estimates three more parameters, it will be more prone to overfitting, especially, of course, if there are indeed only seasonal dynamics at work and no non-seasonal ones (assuming our data is truly generated by any ARIMA process, IMO a heroic assumption).

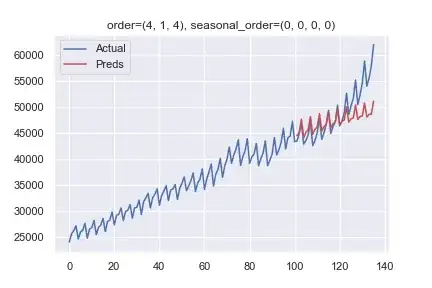

Also, any overfitting will show up more prominently if the seasonal (or other) signal is weaker. In your case, the seasonality is rather blatant, so even quite an overparameterized model does not overfit too badly. Consider adding some noise to your data and running the analysis a couple of times with different random noises of equal strength in each case; the nonseasonal ARIMA model should give you much more variable forecasts than a seasonal one.

Note that this very much depends on your seasonal cycle length. For quarterly data, an $\text{AR}(4)$ model estimates only three more parameters than an $\text{AR}(0)(1)_4$ one. For monthly data, in contrast, we would need to go to an $\text{AR}(12)$ model to be able to capture the seasonality - and this would need to estimate eleven more parameters than an $\text{AR}(0)(1)_{12}$ model, so the likelihood of overfitting will be much higher.

Incidentally, pmdarima.auto_arima() believes your data is $\text{ARIMA}(5,1,0)$ if we do not supply seasonality information.