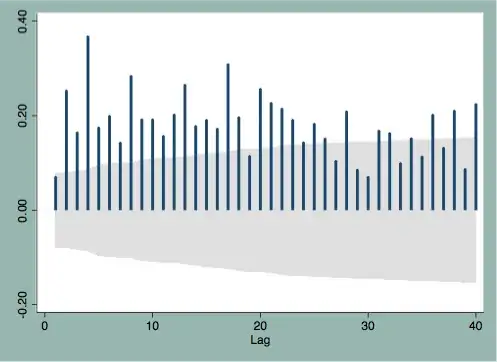

While studying the squared residuals of a financial asset with the ACF, I noticed that there appears to be a pattern at the beginning of the ACF, starting at lag 4. I was wondering whether this might be some kind of ''day in the week'' effect and asked myself whether it would be necessary to correct for this first, similar to seasonality correction in ARIMA models. Therefore, my question: is correction necessary and if so, what approach? Picture of ACF attached.

Asked

Active

Viewed 37 times

1 Answers

0

You can include dummies in the conditional variance equation in the GARCH model. This way you could deal with seasonal effects. However, if the seasonal period of your data is not 4 (for daily data it could be 7 (full week) or 5 (working week)), then finding a large autocorrelation at lags 4 and 8 (and 13 -- not 12) might be due to some other reasons.

Richard Hardy

- 67,272

-

Thanks, Richard Hardy. You're obviously the man for the GARCH questions. – Taufi Mar 09 '16 at 20:59

-

Thanks, @Taufi. It so happens that I have spent some time thinking about GARCH models over the last few years and learnt some stuff that I can now share. – Richard Hardy Mar 09 '16 at 21:17