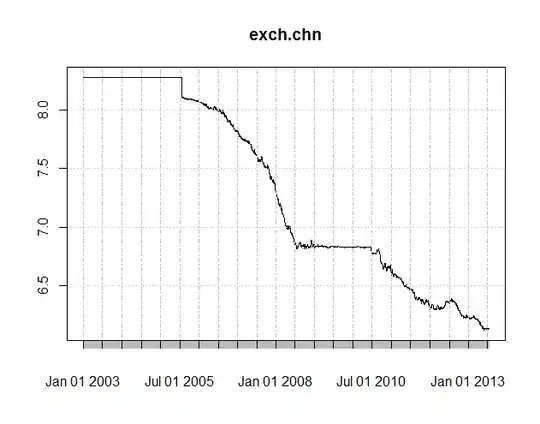

This is CNY to US$:

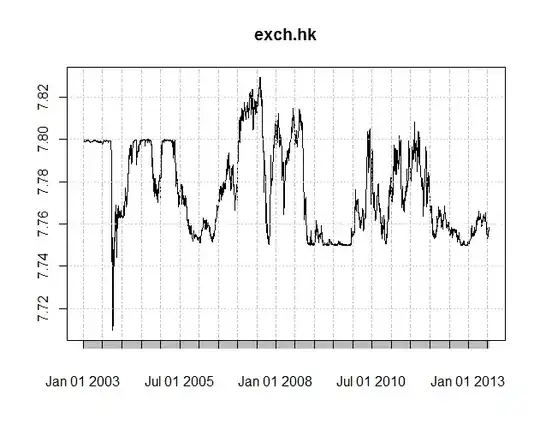

This is HKD to US$:

This is HKD to US$:

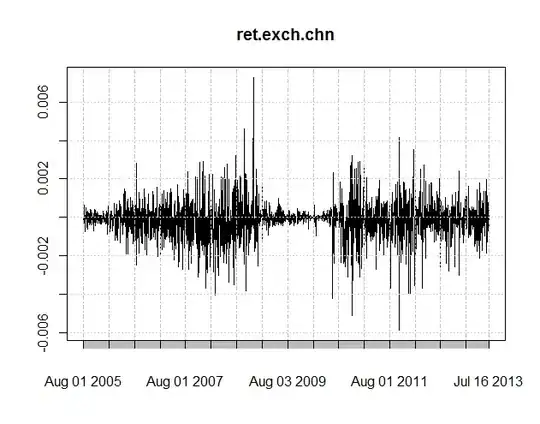

Below are the log of the first difference of both graphs above:

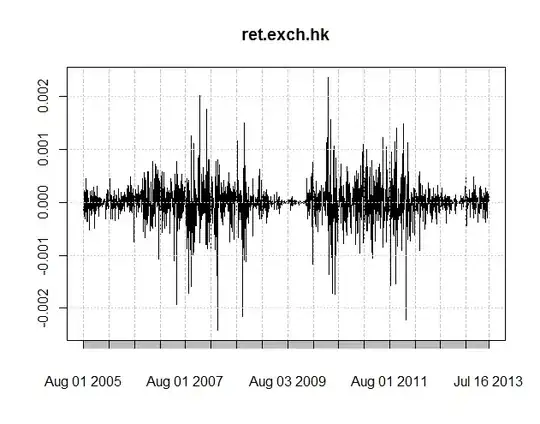

Below are the log of the first difference of both graphs above:

You can see that apparent similarity on the middle of graph. I thought that they were managed by different entity as CNY are managed by People Bank of China (PBC, Central Bank of China) and HKD by Hongkong Monetary Authority CNY exchange rate is a managed float while HKD is pegged.

Questions:

- Were the similarity induced by the same response to the same crisis? Or is it only coincidence? Or was it coordinated between financial authority in China and Hongkong? Or the way of how HK pegged HKD similar to the way how China managed float on CNY?

- What are the implication of it?