S&P seems to publish the earnings at https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx (though I do not regularly use this source and so I don't know how stable that source is). There is a link under https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview (see "Additional Info"). [Note that you can get price data from the same site, by using the "Export" option in the performance chart.]

Robert Shiller's earnings data, with the last two quarters marked (the non-quarter months are interpolated):

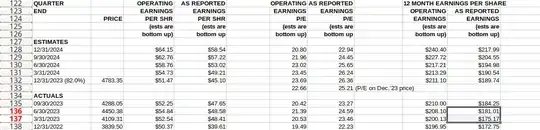

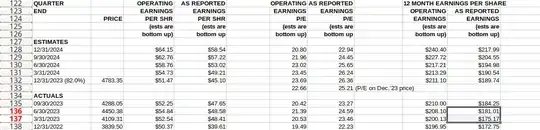

S&P's data with the last quarterly numbers marked:

June differs slightly, but perhaps not all companies have had reported when Professor Shiller had last updated the file.

For the price level, at least in the past, I think he used an average price for the month. Following the comment of @nbbo2 , here is a quick check (in R), comparing Robert Shiller's data with Yahoo:

library("NMOF")

library("tseries")

library("zoo")

Fetch data from Robert Shiller's website:

shiller <- Shiller(tempdir())

shiller.date <- format(shiller[["Date"]], "%Y-%m")

shiller.price <- shiller[["Price"]]

Fetch S&P 500 data from Yahoo:

yhoo <- get.hist.quote("^SPX", quote = "Close")

yhoo <- tapply(coredata(yhoo), FUN = mean,

format(index(yhoo), "%Y-%m"))

yhoo <- yhoo[names(yhoo) %in% shiller.date]

Compare data

keep <- shiller.date %in% names(yhoo)

data.frame(Shiller = shiller.price[keep],

Yahoo = yhoo,

Difference = round(shiller.price[keep] - yhoo, 2))

Shiller Yahoo Difference

1991-01 325.490 325.4855 0.00

1991-02 362.260 362.2632 0.00

1991-03 372.280 372.2790 0.00

1991-04 379.680 379.6786 0.00

1991-05 377.990 377.9923 0.00

....

1997-07 925.290 925.2945 0.00

1997-08 927.240 927.7357 -0.50

1997-09 937.020 937.0243 0.00

....

2002-03 1153.790 1153.7910 0.00

2002-04 1111.930 1112.0345 -0.10

2002-05 1079.250 1079.2673 -0.02

2002-06 1014.020 1014.0480 -0.03

2002-07 903.590 903.5855 0.00

....

2022-11 3917.489 3917.4886 0.00

2022-12 3912.381 3912.3810 0.00

2023-01 3960.657 3960.6565 0.00

2023-02 4079.685 4079.6847 0.00

2023-03 3968.559 3968.5591 0.00

2023-04 4121.467 4121.4674 0.00

2023-05 4146.173 4146.1732 0.00

2023-06 4345.373 4345.3728 0.00

2023-07 4508.076 4508.0755 0.00

2023-08 4457.359 4457.3587 0.00

2023-09 4515.770 4409.0950 106.68

I have suppressed most of the output -- for most months, the difference between the mean S&P and Shiller's price series is zero.

summary(round(shiller.price[keep] - yhoo, 2))

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -6.530 0.000 0.000 0.258 0.000 106.680

The single large deviation of 106 happens in September 2023, because the file had not been updated.