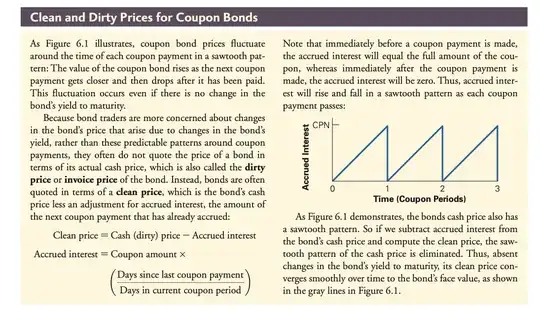

Consider the attached discussion from Berk and Demarzo's Corporate Finance.

I am confused about the calculation of a bond's "clean price". It seems that the procedure described above seems to tacitly "linearly discount" the accrued interest, rather than discounting cash flows with an appropriate factor. Put differently, why does the given graph suggest that Dirty Price grows linearly in between coupon payments, rather than according to some $(1+r)^t$ factor as would be expected based on (rigorous) discounting?