I’m trying to price a call option on EUR/GBP exchange rate and it expires in 1 year. Should I use GBP Libor as foreign risk free rate in order to apply BS formula? The pricing date is 02/21/2023 but in this date there is no 12m GBP Libor https://www.global-rates.com/it/tassi-di-interesse/libor/sterlina-inglese/sterlina-inglese.aspx

-

1Libor is essentially gone and anyhow not used as risk free rates since about 2008. Use SONIA swap rates for the exact term. Also, if you get IVOL from a vendor, you should usually get access to pricing engines too (Reuters, Bloomberg...) No need to do it yourself. – AKdemy Feb 27 '23 at 22:25

-

Can you please share a site that shows SONIA swap rate 1Y on 02/21/23? – user66491 Feb 27 '23 at 22:50

-

1https://www.google.com/search?if I Google [Sonia swap rates](q=sonia+swap+rates&oq=sonia+swap+rate&aqs=chrome.0.0i512j69i57j0i512l2j0i395i512j0i512l3j0i390.7250j1j9&client=ms-android-google&sourceid=chrome-mobile&ie=UTF-8 I get them on the first suggestion (chatam). Again, you will get that where you get your IVOL from. If you don't get IVOL, the rates you use really don't matter much. – AKdemy Feb 27 '23 at 22:55

-

1You may like: https://vskp.vse.cz/english/51683 – Dimitri Vulis Feb 28 '23 at 03:25

-

1Also worth reading how libor swaps were /are constructed. You would never use 12 months libor in any case but usually 3m and construct a swap curve for this tenor only. – AKdemy Feb 28 '23 at 05:39

-

1To be pedantic, what is the collateral currency? That fully determines the discounting question if the deal is collateralized (which all interbank deals are to first order). – river_rat Feb 28 '23 at 20:34

2 Answers

I assume you meant spot FX options. However, I'm going to comment on another answer and associated comments before trying to answer your question.

Using government bond curves is not recommended. See for example Decomposing Swap Spreads by Feldhütter et al. All derivative pricers in Bloomberg for example do not even allow you to select such curves.

Options on spot FX are OTC (over the counter) traded and not listed (few, very illiquid exceptions). Insofar you cannot look up details on the specific exchange. While there are a lot of details and conventions needed to get this right, there is nothing surprising about reproducing industry practices with BS model, by just using the "correct" curves. In fact, that is exactly how Spot FX options are priced all the time.

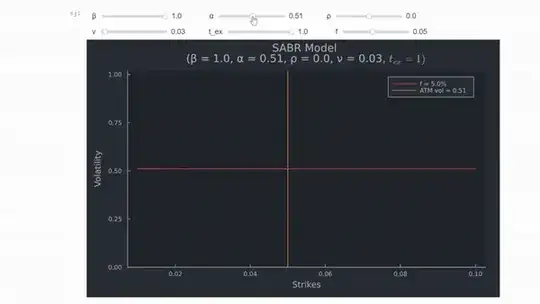

However, listed FX options are options on listed futures. They are price (premium) quoted (CME used to have vol quoted FX options, but they were discontinued last September). Theoretically, options on Futures are priced with Black 76, and there is no need for a second interest rate in this case. The proposed Garman Kohlhagen model cannot be used here. The SABR model is not used in pricing CME FX Futures options. It is merely used in a tool that backs out OTC equivalent implied vols. In a nutshell, it adjusts the futures option strike price by the FX forward swap differential and uses SABR to compute (calibrate) a vol surface. How SABR works is shown in the GIF below, which is taken from this answer.

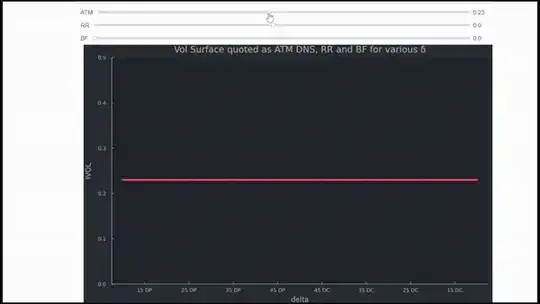

Now, none of this applies to spot fx options. OTC traded FX options are quoted in IVOL. ATM DNS (Delta Neutral Straddles), Risk Reversals and Butterflies for various deltas. The GIF below shows how this builds a vol surfaces. As you can see, the outcome /shape is similar to SABR. After all, the idea of the CME FX options vol converter is to provide price transparency between the OTC and CME options markets.

These quotes have a cut-off time (frequently New York 10am) when the option expires. EURGBP is by convention also delta premium included. This is explained in this mathfinance paper by Uwe Wystup and Dmitri Reiswich. This answer shows in Julia code what delta premium adjusted means. Solving for strike is not that trivial in this case and requires a root solver.

Once you dealt with all the complexities of getting the correct implied vol, which is a lot more important for pricing an option, you can think of interest rates. Generally, the RFR (for risk free rate) swap rates (SOFR for USD, ESTR for EUR, SONIA for GBP for example) are used, and you have a choice for other swap curves like Euribor and Libor (legacy reasons) as well as other OIS swaps like the Fed funds swaps. CME and LCH moved to SOFR PAI and discounting on Oct. 16 2020 on new AND legacy swaps. For EUR cleared, major CCPs did this since July 27 2020. The market also switched to discounting with the relevant RFR rates on these dates. Even if you use Libor rates, you would not use a 12m tenor. Some food for thought can be found in this answer.

With FX, you also face a "consistency problem", because Spot, and two interest rates determine the FX forward quote (uncovered interest rate parity). Therefore, it is common practice to imply the least liquid interest rate (FX Forward quotes are very liquid in the short to medium term and already include any cross currency basis adjustment). This implied rate would be GBP in your case. An example showing how you imply a rate can be found here.

Now, you can compute the market value of the option. This answer replicates Bloomberg with Julia code. It is just Black Scholes (Garman Kohlhagen) but not straightforward if you have never done it before, because you need to know what direction a call is (on EUR for EURGBP), what notional currency is (EUR for EURGBP) and what premium currency is (GBP for EURGBP). All else requires adjustments as shown here. Ideally you also account for two different time gaps as done in OVML:

a) time to expiry = Expiry Date - Price Date

b) time to delivery = Delivery Date - Premium Date

- 9,269

- 1

- 23

- 90

As suggested by Wikipedia, the most common model to price European options on FX is Garman-Kohlhagen: $$ C(S,T) = S_0 \, e^{-r_f \, T}\mathcal{N}(d_1) - K \, e^{-r_d\ T}\mathcal{N}(d_2) $$

To find $r_f$ and $r_d$ you need EUR and GBP yield curves for spot or forward rate (both are just different representation of the same data).

EUR curve is published by European Central Bank, see Euro Area Yield Curves. What you need is spot rate, use Svensson parametrization also provided there to get exact rate for a given $T$.

GBP curve is published by Bank of England, see Yield Curves for the UK. Not sure if they provide some continuous-time parametrization, like for EUR, but you might choose to use some interpolation.

On both portals you will find plenty information on the calibration methodology, traded instruments used, etc.

- 399

- 1

- 5

-

2The ECB link you sent are bond curves. There is work on why government bonds are not a good proxy (usually based on convenience yield arguments). See for example Decomposing Swap Spreads by Feldhütter et al.. Bloomberg for example does not even allow such curves on all their derivatives pricers. Ultimately, the IV will be the most difficult and important part in the whole exercise though. – AKdemy Feb 28 '23 at 19:57

-

@AKdemy Obviously, there are many markets to calibrate a yield curve from. Even more IR models exist to simulate various market effects, interpolation, etc. I don't think any exchange is using 5-factor IR model to risk manage FX options.

Posted curves should be good enough for the initial implementation. Further, I'd suggest to refer to materials on the specific exchange.

– kwinto Feb 28 '23 at 21:02 -

2

-

2@gituliar The comments below the questions provide the correct framework/answer. The solution you proposed unfortunately does not conform to real-live market conventions. – Helin Feb 28 '23 at 22:17

-

Uwe Wystup FX options and structured products (2017) page 6: ". Model (1) is sometimes referred to as the Garman-Kohlhagen model [54]. However, all that happened there was adding the foreign interest rate $r_f$ to the Black-Scholes model [15]. For this reason Model (1) is generally and in this book referred to as the Black-Scholes model." – Dimitri Vulis Feb 28 '23 at 22:40

-

@kwinto what exchanges list EUR/GBP options please? Also, can you point to sample materials please, where an exchange allows using bond yields curve for discounting derivatives? – Dimitri Vulis Mar 01 '23 at 11:32

-

@DimitriVulis Good question. CME has FX Options on Futures (EUR/GBP is not there) + FX Options Methodology to calibrate the model. Not surprisingly, SABR model they use is sligtly more advanced than BS. :) I am surprised that people here expect to reproduce industry practices with BS model, just using the "correct" curves. I'd assume, by how it is stated, that the question has more educational nature. – kwinto Mar 01 '23 at 13:36

-

1

-

-

1