https://economics.stackexchange.com/questions/16115/what-is-the-equation-mathbbemr-1

The above post asks what $$\mathbb{E}[mR]=1$$ means and gets some great answers. From the first answer is seems that the physical rather than risk neutral probabilities are used to take the expectation.

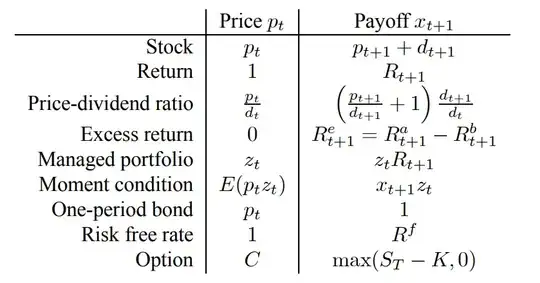

I'm reading the paper "Characteristics are Covariances" on p2 they introduce the Euler equation as:

$$\mathbb{E}[mR]=0$$

I have not seen this formulation from the paper anywhere else. They say that the only assumption used was that of "no arbitrage". The paper does not state which measure was used to take the above expectation, but given the prices are arbitrage free I am assuming it is a risk neutral one.

A I correct to think that the expectation in the paper is taken under the risk-neutral measure?

Is it the switch from the physical to risk neutral measure that causes the difference on the rhs of the two expressions, if so can someone run me through the derivation?

Intuitively the first formulation seems to be a martingale but is calculated under the physical measure so I am assuming it is not arbitrage free can a price process be a martingale but still not be arbitrage free?

Thanks

Baz