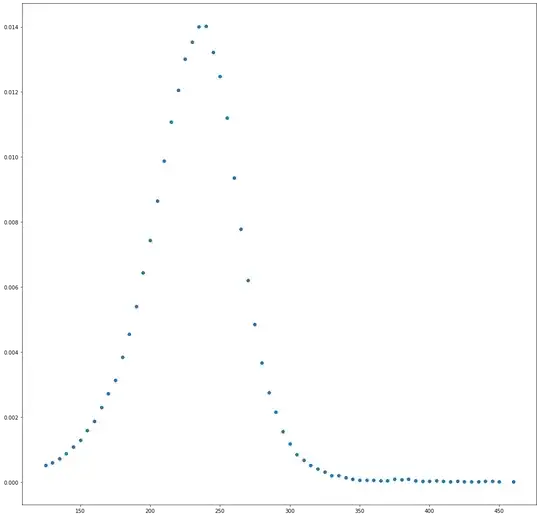

I derived the pdf using the butterfly prices and the curve looks like gamma of an option at every strike.  Is that the case or am I missing something to get the pricing of an option?

Is that the case or am I missing something to get the pricing of an option?

- 23

- 3

1 Answers

In many option pricing models, the option price is homogeneous of degree one, $$C(\lambda S_t,\lambda K)=\lambda C(S_t,K).$$ This property applies to most stochastic volatility and exponential Lévy models. One big exception are local volatility models. Essentially, the condition holds if doubling $S_t$ also doubles $S_T$ (because, for example, $S_T=S_te^{X_{T-t}}$). Then, \begin{align} C(\lambda S_t,\lambda K)&=e^{-r(T-t)}\mathbb{E}^\mathbb{Q}_t[\max\{\lambda S_T-\lambda K,0\}] \\ &=\lambda e^{-r(T-t)}\mathbb{E}^\mathbb{Q}_t[\max\{S_T-K,0\}]\\ &=\lambda C(S_t,K). \end{align}

Differentiating with respect to $\lambda$ implies \begin{align*} S_t\frac{\partial C}{\partial S_t}+K\frac{\partial C}{\partial K}=C. \end{align*} This resembles Euler's homogeneous function theorem. Due to monotonicity in strike, we know that $\frac{\partial C}{\partial K}<0$.

Further differentiation with respect to $S_t$ and $K$ implies \begin{align*} S_t^2\frac{\partial^2 C}{\partial S_t^2}=K^2\frac{\partial^2 C}{\partial K^2}. \end{align*} Due to convexity in strike, we know that $\frac{\partial^2 C}{\partial K^2}>0$.

From Breeden-Litzenberger (1978), \begin{align*} q(K) &= e^{rT}\frac{\partial^2 C}{\partial K^2}\\ &= e^{rT}\frac{S_t^2}{K^2}\frac{\partial^2 C}{\partial S^2} \\ &= e^{rT}\frac{S_t^2}{K^2}\Gamma. \end{align*} You can thus see that the risk-neutral density is indeed closely linked to gamma. You're right.

Note that the equations $S_t^2\frac{\partial^2 C}{\partial S_t^2}=K^2\frac{\partial^2 C}{\partial K^2}$ and $S_t\frac{\partial C}{\partial S_t}+K\frac{\partial C}{\partial K}=C$ can be used to calculate gamma and delta in an (almost) model-free fashion, namely \begin{align} \Delta &=\frac{C}{S_t}-\frac{K}{S_t}\frac{\partial C}{\partial K}, \\ \Gamma &=\frac{K^2}{S^2_t}\frac{\partial^2 C}{\partial K^2}. \end{align}

- 15,879

- 4

- 31

- 64

-

Thanks for the answer! So does that mean I can just use the gamma at every strike to derive the pdf and then integrate that curve to get the delta and prices? – vedant bajaj Oct 24 '22 at 18:34

-

1@vedantbajaj If we knew the right gamma. I added a point about getting gamma from observable option prices, but there is a small modelling assumption that Breeden Litzenberger does not require. – Kevin Oct 24 '22 at 18:41