Now I'm studying this textbook ( Fixed Income Securities by Veronesi ). But this page gets me some trouble.

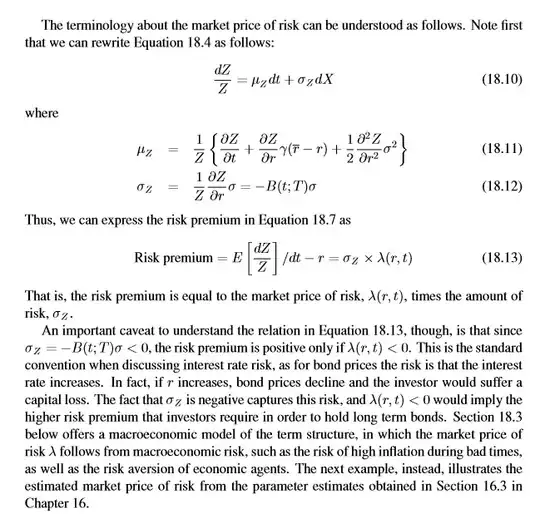

I know that yield and Bond Price have negative relationship. But in this image, it says sigma_z(Risk)'s negative sign captures this risk. What does it mean totally? Why it should have negative sign to explain the fact that Bond yield and Bond Price have negative relationship?

Also, See Lambda term. it says lambda(r,t) < 0 would imply the higher risk premium that investors require in order to hold long term bonds. What is the reason? Why below zero imply the higher risk premium that investors require in order to hold long term bonds ?

I'm studying this textbook by myself and the contents is not enough to understand this intuition. I need your help sincerely.

Thanks.