We are now building DI futures in our system for a customer who is planning to trade Brazilian DI futures in the nearest future

I have a couple of question on the specification and the calculations

- Correction factor calculation : question 1 According to DI futures spec correction factor is calculated based on this formula:

FCt = (1 + DIt-1/100)^(1/252)

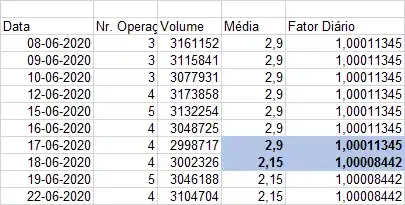

I have found that B3 exchange is showing the following numbers for FC We see DI rate change from 17-06 to 18-06, and correction factor changed as well which is the confirmation that correction factor is not based on the previous DI rate value i.e. FC is based on DIt instead of DIt-1

http://estatisticas.cetip.com.br/astec/series_v05/paginas/lum_web_v04_10_03_consulta.asp

- Question 2 on correction factor

If we have a public holiday and n>1 between today and previous trading session, what is the rate used on the public holiday , is it ‘0’ or the rate from the previous trading session I do not see the product of correction factors

In the above screenshot; 11th June is the public holiday but I do see any impact on FC calculations