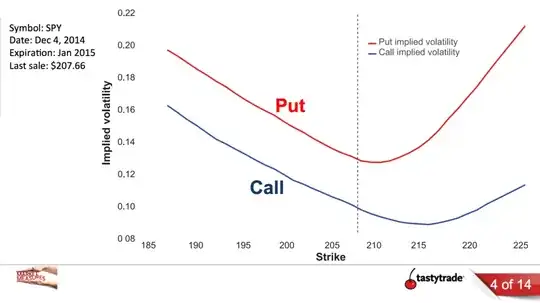

I was trying to create a replication portfolio of options for a Variance Swap and noticed that there is a jump when moving from below strike puts to above strike calls. Something similar to this:

I was curious why would that happen and a quick search brought me to this discussion.

The accepted answer states that:

In practice you use puts for low strikes and calls for high strikes, since the OTM are more liquid. Low/high is relative to the forward price.

- So if we are using puts for low strikes and calls for high strikes, wouldn't the IV curve be broken at Forward Price?

- Is the reason for using puts for low strikes and calls for high strikes just the liquidity issue? Or are there other reasons for this?

- And finally, why would we use Forward Price, not Spot Price?

Thanks!