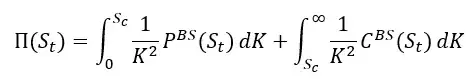

I didn't find the formula for the following portfolio (variance swap replication) with nonzero risk-free rate and nonzero dividend under black and scholes model :

I found formula and proof only with risk-free rate and dividend equal to zero under black and scholes :

An explicit formula exist (as (2)) for nonzero risk-free rate and nonzero dividend ? If yes, what is the result ? (Carr-Madan is not an explicit formula)

Thanks