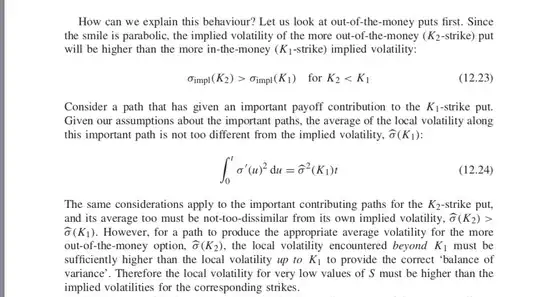

He is basically saying that the main path from A to B prices the option at strike B with respect to A, and if it has an implied vol of $x$, then that main path also has a vol of $x$.

If you have an option at strike C (which is further away than B from A) then its main path from A to C has to also have a vol reflective of the implied vol, i.e a vol of $y > x$ greater than the vol of B.

The key is that the main path A -> B -> C is the same in both cases for the part A -> B, so if C has a higher vol it must be the part of the path B -> C that takes up the slack and has a higher volatility to statistically account for the difference. And this volatility is local to C since it is beyond B.