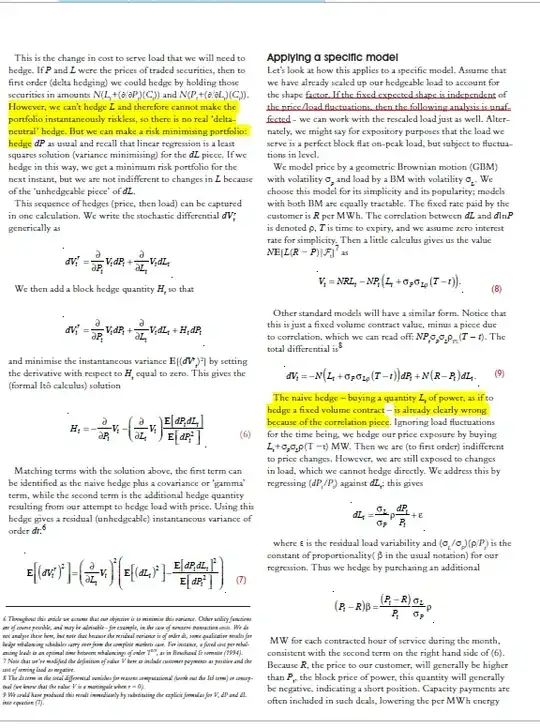

In a paper from Energy Risk - "Delta hedging the load serving deal", the author shows how to calculate the min variance hedge for a portfolio of two underlying assets. I've added a picture of the relevant section (I don't think I can upload the paper here):

My attempted solution is also attached:

I "sort of" get to the solution...but not quite. I did not apply Ito's Lemma to begin with. The main shortcut I took is - I took the partial derivatives of V with respect to P and L (the two assets) out of the expectations operator (see note 1 at the bottom of the second image). I'm not sure why this operation is allowed (or is it allowed at all)? So while I match the equation 6 from the paper, I'm not convinced that I've done it correctly.Has anyone seen a result like this before? Any guidance is appreciated. Thanks