Throughout the answer we assume a Black-Scholes framework, noting $C_{BS}(t,T)$ and $P_{BS}(t,T)$ the prices at $t$ of a call and a put option written on an underlying $X_t$ and with maturity $T$. In general, the subscript $BS$ will designate the Black-Scholes price of a derivative.

A straddle of strike $K$ corresponds to a simultaneous long position in a call option and in a put option both with strike $K$. Letting $V(t,T)$ be the value at $t$ of a straddle with maturity $T$, by call-put parity:

$$ V(t,T) = C(t,T)+P(t,T)=2C(t,T)+e^{-r(T-t)}K-X_t$$

Assuming no revenue (i.e. dividends) or cost yield, if the straddle is at-the-money (ATM) forward:

$$ V(t,T) = 2C(t,T)$$

Now, letting $\sigma_X^{\star}$ be the ATM volatility of underlying $X_t$, a useful approximation of the Black-Scholes formula for ATM calls is:

$$ C_{BS}(t,T) \approx 0.4X_t\sigma_X^{\star}\sqrt{T-t} $$

Thus:

$$ V_{BS}(t,T) \approx 0.8X_t\sigma_X^{\star}\sqrt{T-t}$$

Moreover, note that your straddle is written on returns instead of prices/levels, hence when the straddle is ATM the approximation simplifies to:

$$ V_{BS}(t,T) \approx 0.8\sigma_X^{\star}\sqrt{T-t}$$

In your formula, the scaling factor $0.8$ and the square root will cancel, leaving:

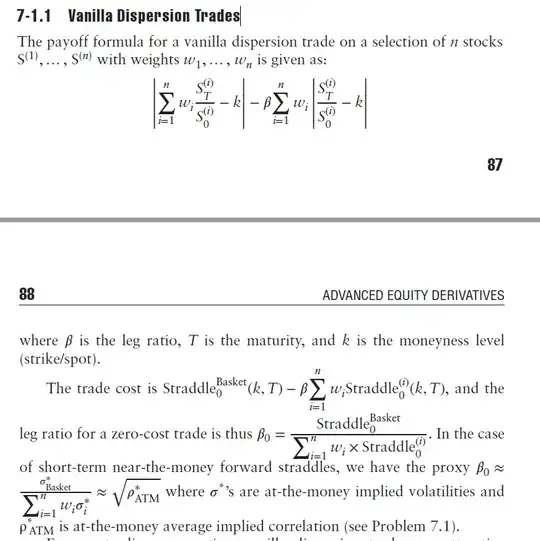

$$ \beta_0 = \frac{V_{BS}(t,T,B_t)}{\sum_{i=0}^n{w_iV_{BS}(t,T,S^{(i)}_t)}} \approx \frac{\sigma_B^{\star}}{\sum_{i=0}^n{w_i\sigma_i^{\star}}} $$