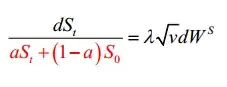

If we take the heston model but change it slightly by introducing a new parameter $\alpha$ such that

is there a way to price the call option within this model as, maybe, a function of the call price within the original model? Or a function of $S_T$ as simulated from the original model?