Based on this topic: How to derive the implied probability distribution from B-S volatilities?

I am trying to implement the Breeden-Litzenberger formula to compute the market implied risk-neutral densities for the S&P 500 for some quoting dates. The steps that I take are as follows:

Step 1: Extract the call_strikes c_strikes for a given maturity T and the

corresponding market prices css.

Step 2: Once I have the strikes and market prices, I compute the implied volatilities via the function ImplieVolatilities.m I'm 100% sure that this function works.

Step 3: Next, I interpolate the implied volatility curve by making use of the Matlab command interp1. Now, the vector xq is the strikes grid and the vector vqthe corresponding interpolated implied volatilities.

Step 4: Since I have to volatility curve, I can compute the market implied density: \begin{align} f(K) &= e^{rT} \frac{\partial^2 C(K,T)}{\partial K^2} \\ &\approx e^{rT} \frac{C(K+\Delta_K,T)-2C(K,T)+C(K-\Delta_K, T)}{(\Delta_K)^2} \end{align} where $\Delta_K = 0.2$ is the strike grid size. I only show the core part of the Matlab program:

c_strikes = Call_r_strikes(find(imp_vols > 0));

css = Call_r_prices(find(imp_vols > 0));

impvolss = ImpliedVolatilities(S,c_strikes,r,q,Time,0,css); %implied volatilities

xq = (min(c_strikes):0.2:max(c_strikes)); %grid of strikes

vq = interp1(c_strikes,impvolss,xq); %interpolatd values %interpolated implied volatilities

f = zeros(1,length(xq)); %risk-neutral density

function [f] = secondDerivativeNonUniformMesh(x, y)

dx = diff(x); %grid size (uniform)

dxp = dx(2:end);

d2k = dxp.^2; %squared grid size

f = (1./d2k).*(y(1:end-2)-2*y(2:end-1)+y(3:end));

end

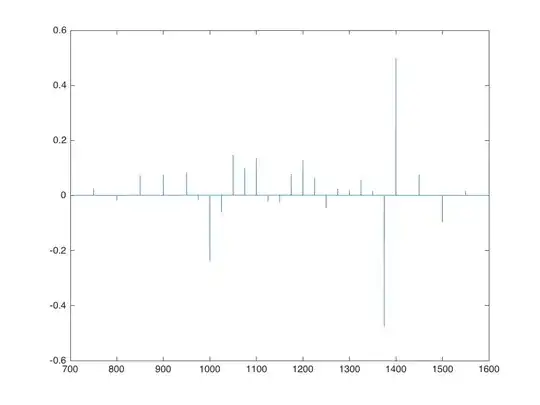

figure(2)

plot(xq,f);

Note: blsprice is an intern Matlab function so that one should definitely work.

This is the risk-neutral pdf for the interior points:

The data The following table shows the option data (left column: strikes, middle: market prices and right column: implied volatilities):

650 387.5 0.337024

700 346.45 0.325662

750 306.8 0.313846

800 268.95 0.302428

850 232.85 0.290759

900 199.15 0.279979

950 168.1 0.270041

975 153.7 0.265506

1000 139.9 0.260885

1025 126.15 0.255063

1050 112.9 0.248928

1075 100.7 0.243514

1100 89.45 0.238585

1125 79.25 0.234326

1150 69.7 0.229944

1175 60.8 0.22543

1200 52.8 0.221322

1225 45.8 0.21791

1250 39.6 0.21486

1275 33.9 0.21154

1300 28.85 0.208372

1325 24.4 0.205328

1350 20.6 0.202698

1375 17.3 0.200198

1400 13.35 0.193611

1450 9.25 0.190194

1500 6.55 0.188604

1550 4.2 0.184105

1600 2.65 0.180255

1650 1.675 0.177356

1700 1.125 0.176491

1800 0.575 0.177828

$T = 1.6329$ is the time to maturity, $r = 0.009779$ the risk-free rate and $q = 0.02208$ the dividend yield. The spot price $S = 1036.2$.

Computation of the risk-free rate and dividend yield via Put-Call parity $r$ is the risk-free rate corresponding to maturity $T$ and $q$ is the dividend yield. In the numerical implementation, we derive $r$ and $q$ by again making use of the Put-Call parity. To that end, we assume the following linear relationship: $$f(K) = \alpha K-\beta,$$ where $\alpha = e^{-rT}$ and $-e^{-qT}S(0) = \beta$, and $f(K) = P(K,T)-C(K,T)$. The constants $\alpha$ and $\beta$ are then computed by carrying out a linear regression. Consequently, the risk-free rate $r$ and dividend yield $q$ are then given by \begin{align} r &= \frac{1}{T}\ln\left(\frac{1}{\alpha}\right), \nonumber \\ q &= \frac{1}{T} \ln \left(\frac{-S(0)}{\beta}\right). \nonumber \end{align}