Any idea where lies the problem? Thank you for suggestions.

Asked

Active

Viewed 458 times

8

Michael Mark

- 766

- 5

- 14

-

2I believe that there is a typo, that is, $e^{\mu(T-t)}S$ should be $e^{r(T-t)}S$. You can not, under the same risk-neutral measure, use one drift for one formula, and use another drift in another case. – Gordon Jul 27 '16 at 18:36

-

3In the absence of arbitrage opportunities, and in the absence of uncertainty, the drift of the stock $\mu $ under the objective measure $\mathbb {P} $ should be equal to the risk-free rate, hence no paradox. This can be seen by a simple cash-carry argument. – Quantuple Jul 27 '16 at 18:59

-

2Agree with Quantuple. A volatility of zero implies that the asset is risk-free, and so $\mu=r$. – Olaf Jul 27 '16 at 19:01

1 Answers

5

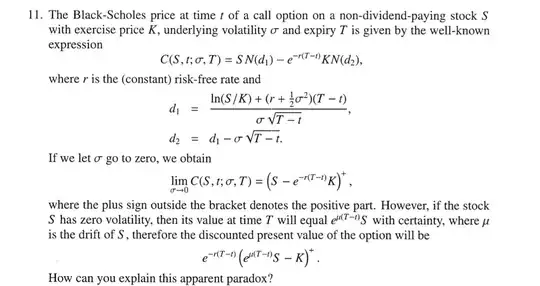

In the absence of uncertainty, the drift of the stock $\mu$ under the objective measure $\mathbb {P} $ should be equal to the risk-free rate $r$ (*) to preclude arbitrage opportunities. Hence, there is no paradox, since the two formulas coincide under such circumstances.

To convince yourself, consider the following thought experiment. At time zero, suppose that you possess a cash amount $S_0$, which you would like to invest. You come up with 2 different investment ideas:

- Buy the stock at time zero. With certainty your long position will be worth $S_0e^{\mu T}$ at time $T$.

- Invest your cash in the risk-free money market account at time zero. This will get you $S_0e^{r T} $ with certainty at time $T$.

It is clear that you should have $r=\mu$ to preclude arbitrage opportunities in that case.

(*) $r$ happens to be the drift required under the risk-neutral measure $\mathbb {Q} $, i.e. the drift assumed when deriving the BS formula

Quantuple

- 14,622

- 1

- 33

- 69