Assuming you've used this definition for the NIG distribution and that you've managed to come up with estimates $(\hat{\alpha}, \hat{\beta}, \hat{\mu}, \hat{\delta} )$ of the individual NIG parameters, your question boils down to:

"How to simulate paths from the global log-return process $R_t = \ln(S_t/S_0)$ for all $t \in [0,T]$, assuming i.i.d. $NIG(\hat{\alpha}, \hat{\beta}, \hat{\mu}, \hat{\delta} )-$distributed periodic log-returns (in your case daily)?"

First of all, no, you cannot use the equation you mention.

Yet, because the NIG distribution is a special case of normal variance-mean mixture (see this document, page 14), if one lets

\begin{align}

\sigma^2 &\sim IG\left( \frac{\delta}{\gamma}, \delta^2 \right),\ \ \text{with } \gamma = \sqrt{ \alpha^2 - \beta^2 } \\

\varepsilon &\sim \mathcal{N}(0,1)

\end{align}

then the random variable $X$ defined as

$$ X = \mu + \beta \sigma^2 + \sigma \varepsilon $$

follows a $NIG(\alpha,\beta,\mu,\delta)$ distribution.

Now, let $r_{\delta t, i}$ denote the $\delta t$-period log-return observed for a given $t_i \in [0,T]$

$$ r_{\delta t, i} := \ln\left( \frac{S_{t_i}}{S_{t_i-\delta t}} \right) $$

You can then proceed as follows to generate realisations of the global return process $(R_t)_{t\geq 0}$.

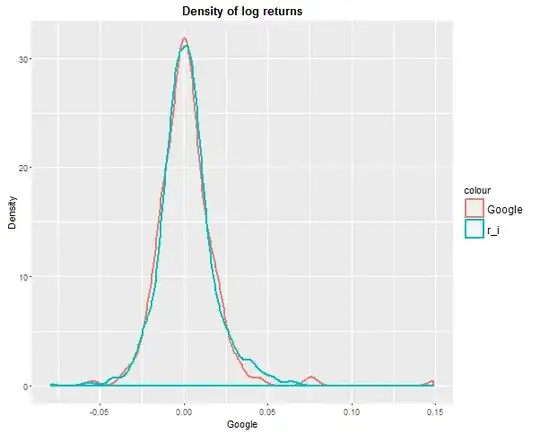

Under the assumptions of i.i.d. NIG-distributed $\{r_{\delta t, i}\}$, estimate the NIG parameters $(\hat{\alpha}, \hat{\beta}, \hat{\mu}, \hat{\delta} )$ from historical data using your favourite method (Maximum Likelihood Estimation, Moment Matching etc.).

To simulate the periodic log-returns $\{r_{\delta t,i}\}_{i=1,...,N}$ (in practice $N = T/\delta t$ where $T$ figures the horizon of your MC simulation and $\delta t$ the length of the period over which the individual periodic log-returns prevail) use the key result mentioned above by (i) generating $\sigma_i^2 \sim IG(\hat{\delta}/\hat{\gamma}, \hat{\delta}^2)\ \ \text{i.i.d.}$ (see here for instance), (ii) generating $\varepsilon_i \sim \mathcal{N}(0,1) \ \ \text{i.i.d.}$ (iii) computing

$$ r_{\delta t,i} = \hat{\mu} + \hat{\beta} \sigma_i^2 + \sigma_i \varepsilon_i $$

Once all $\{r_{\delta t, i}\}_{i=1,...,N}$ have been simulated, build the global return process $(R_t)_{t\geq 0}$ by aggregating a certain number $n$ of periodic returns. Indeed, for any fixed $t \in [0,T] $, the global log-return $R_t := \ln(S_t/S_0)$ computes as:

\begin{align}

R_t &= \ln\left(\frac{S_t}{S_0}\right) \\

&= \ln\left(\frac{S_t}{S_{t-\delta t}} \frac{S_{t-\delta t}}{S_{t- 2\delta t}} \dots \frac{S_{\delta t}}{S_{0}}\right) \\

&= \sum_{ t_i \in [\delta t, t] } \ln \left( \frac{S_{t_i}}{S_{t_i-\delta t}} \right) \\

&= \sum_{i \leq n} r_{\delta t,i}

\end{align}

This method was first proposed by Rydberg in:

T. H. Rydberg. The normal inverse Gaussian Lévy process: simulation and approximation. Comm. Statist. Stochastic

Models, 13(4):887–910, 1997.