My example is saving for college:

- assume a start of 0 balance

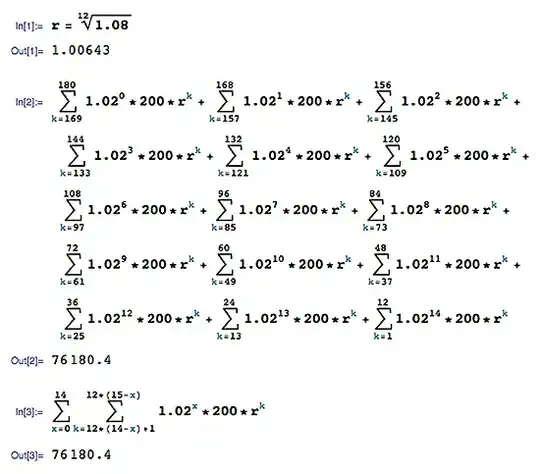

- deposits of 200 made monthly, every year they increase by (g) 2% to account for salary increases, first deposit made at the end of the first month

- Interest Rate (r) is constant at 8% (effective rate)

- Goes for (n=15) years

What is the future value?

Even though I can convert the yearly rate into a compounded monthly rate to match the yearly rate, I can't use the "future value of a growing annuity" formula, that assumes timing of growth and payment are the same.

It is acceptable to make it a two or three steps (like use equation 1 to solve for a new value for payment to plug that into equation 2), I am just trying to avoid making calculations for each and every year as I'm doing now.

n(1) = 2486

n(2) = 5222.23

n(15)= 75693

Update

I found my own answer as well below that combines well known formulas to get to the same answer (and I presume, with substitution, would be equivalent to the accepted answer)

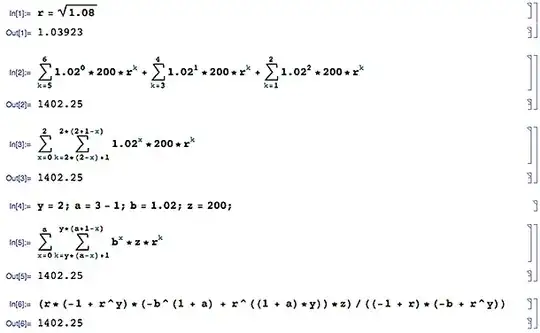

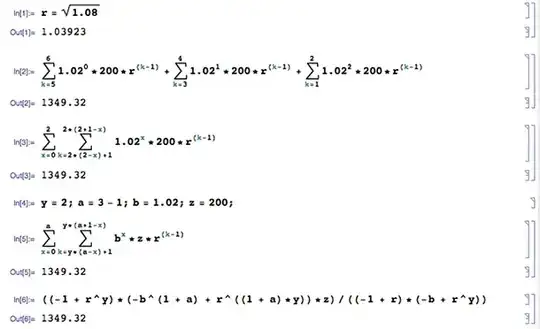

r = 1.03923which is the six-monthly example rate, so taking that simpler example's figures: 3 years, 6 deposits, over 3 years the first deposit builds to1.02^0*200*r^6 = 251.942, the second to1.02^0*200*r^5 = 242.432, the third to1.02^1*200*r^4 = 237.946, etc. on up to six deposits. The first deposit rate term1.02^0is included so that the calculation for every deposit is a standard form for the sum expression. – Chris Degnen May 10 '14 at 23:33