There's several causes of the current inflation problem

COVID-19 shut the world down for a short time

March and April of 2020 were remarkable in that most of the world shut down. Very little was made, shipped or unloaded. And countries took various tracks to reopen after that shutdown. Covid didn't stop either, it just meant nobody could afford to maintain stricter shutdown.

What happened next was a series of "supply bubbles" that have (and still are) transiting through the various economies of the world as shortages impact various parts at strange times. As such, prices tend to rise in a temporary fashion. This is what experts call transitory inflation. From the first link, they talk about the price of lumber

At its height this spring, lumber was up over 300%. Some in the industry even started wondering if the pandemic-spurred housing and DIY booms would keep wood prices permanently elevated. Of course, we now know the verdict is no: Since peaking in May, lumber prices are down 69%.

Transportation woes

For instance, the Port of Los Angeles has a decent backlog of ships

The number of container ships queuing to enter the ports of Los Angeles and Long Beach declined to 78 vessels on Tuesday, down from the peak of 109 ships reached a month earlier, according to the Marine Exchange of Southern California.

That's just container ships. There was a long-building truck driver shortage as well. Fewer trucks means that goods don't get delivered to shelves for purchase, which means shortages and price increases.

The War in Ukraine

This has exacerbated shortages at a time when supplies were already low. In particular there is an embargo on most Russian products (like oil) and Ukraine itself is having difficulty exporting things it normally sells abroad (like wheat).

US Politics

This is the Biden part. The American Rescue Plan Act bill spent a lot of money on the US economy, including

- Distribute $1,400 per person in relief payments

- Extend unemployment benefits to September 6, 2021

- Increase Supplemental Nutrition Assistance Program (SNAP) benefits by 15 percent through September 2021

- Increase the Child Tax Credit from $2,000 to $3,000 per child over age 6 and $3,600 per child under age 6

- Increase the Earned Income Tax Credit

- Expand childcare assistance and provide an additional tax credit for childcare costs

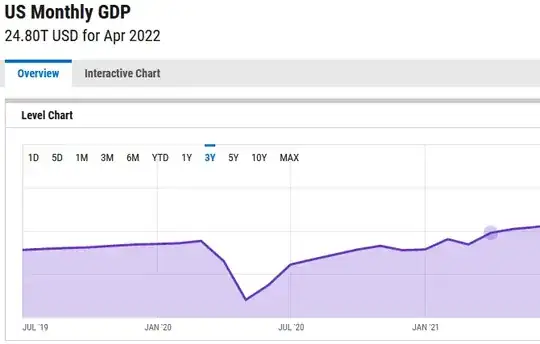

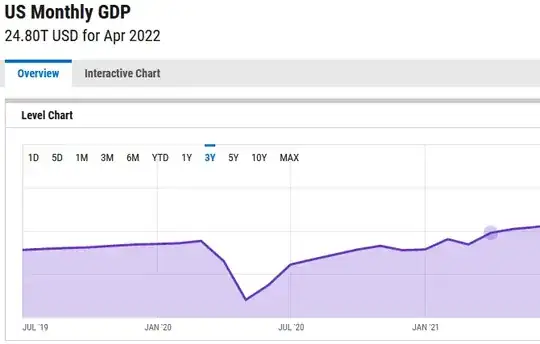

Now, to be fair, this was stimulus round #3, and rounds #1 and #2 were bipartisan and distributed under Donald Trump (both were passed in 2020, when the country was still affected by Covid). What differentiates this is that it was passed in March of 2021 with only Democratic votes. When you look at the GDP graph, you can clearly tell when the shutdown occurred. The dot on the graph is March 2021, when the act was passed. You'll note the economy in March 2021 was larger than it was in Feb 2020 (just before the pandemic).

Still, Democrats insisted the spending was necessary to save the economy

And we’ve heard a lot about how the American Rescue Plan will prime the American economy to come roaring back. Economists are already projecting that economic growth could double as a result of the American Rescue Plan. When over 85% of American households get some checks and the money goes out, it starts revitalizing our economy: people shop in the stores, eat at the restaurants, even begin to travel, see their relatives maybe for the first time, if people are vaccinated. Wow, this is great news. This is great news. So I think America is turning the corner and I think the attitude of Americans is turning the corner as well. People now see a brighter future for this country and their regions.

In practice, what this did was to give everyone the $1400 per person plus up to $300/mo per child for 6 months and an additional tax credit on top of that. The goal was to create a new Federal subsidy

There are no more advance monthly payments, 17-year-olds no longer qualify for the credit and parents or guardians will now need to file a tax return to receive the credit next tax season. It will also be worth significantly less — up to $2,000, compared to up to $3,000 to $3,600 in 2021 — and is no longer fully refundable.

Fully refundable means that if you paid no taxes, the government would give you that amount as a "refund".

Biden and Democrats also want to pass the "Build Back Better" plan in addition to this, which costs around $2T. Bernie Sanders (who ran against Biden in 2020) wanted $6T, with the actual consensus plan being as high as $3.5T.

Biden has also paused US student loan repayments, which is not helping things

The administration’s decision to extend the student loan moratorium through Aug. 31 will keep money in the hands of millions of consumers who can spend it, helping to sustain demand. While the effect on growth and inflation will most likely be very small — Goldman Sachs estimates that it probably adds about $5 billion per month to the economy — some researchers say it sends the wrong message and comes at a bad time. The economy is booming, jobs are plentiful and conditions seem ideal for transitioning borrowers back into repayment.

This all plays into the perception that Democrats are at fault for inflation (this is an opinion article)

A major inflation driver was last year’s $1.9 trillion American Rescue Plan. At the time, the Congressional Budget Office estimated that the baseline economy would operate $420 billion below capacity in 2021 and then gradually close that output gap by 2025. While some stimulus was justified, lawmakers shot a $1.9 trillion bazooka at a $420 billion output gap. And this was just weeks after the December 2020 stimulus law poured in $900 billion. Economists on the left and right, such as Lawrence Summers, warned this excessive stimulus would bring inflation. They were right.

TL;DR

No world leader can stop inflation at present, due to the rolling transitory inflation spikes still rippling through the economy. Where people are blaming Biden is that he, and his party, have spent large sums of money (which are now circulating in the economy) and wish to spend even more. Biden is being perceived as not taking the problem seriously enough.