I'm applying for a US federal grant and their budget requirements require the following format of itemized costs. Note: I'm unsure if this question belongs on this Stack Overflow. If not, please redirect me to the correct SO.

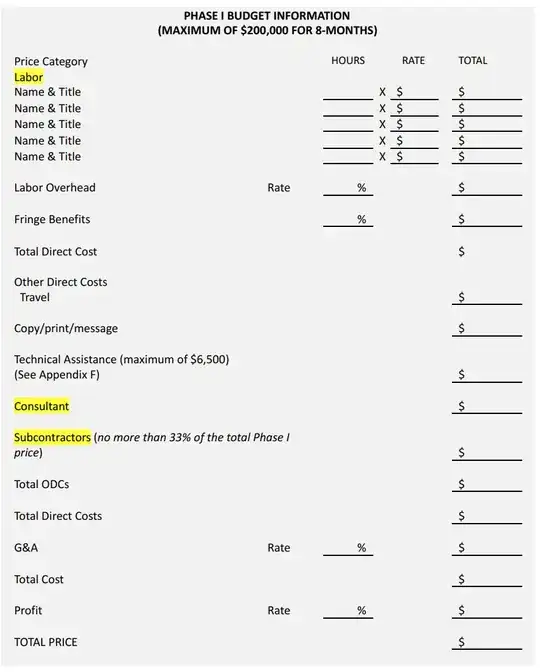

I'm confused on a few terms: labor vs consultant vs subcontractor.

To help with my project, of which I am the Principal Investigator on, I've hired:

- 1 software engineering agency which has dedicated three of its people to the project

- 1 PhD professor from a college institution to lead research

- 2 teachers to help with curriculum design

- 2 college graduate students to help with test result data collation

I'm confused on how to categorize these team members. None of them are full time employees, so there would be zero fringe benefits, but would they all be considered Labor, Consultant, or Subcontractors? Or a mix of each?

It would seem to me that anyone not employed full time with me is a subcontractor, and the college PhD assisting with research would be a consultant.

Please assist me with these definitions. Here is the template the federal grant has provided in their RFP: