I was contacted by a 'broker' in January, they said they're based in Switzerland (I'm based in the UK), and they asked to invest some money (as minimum as $1000).

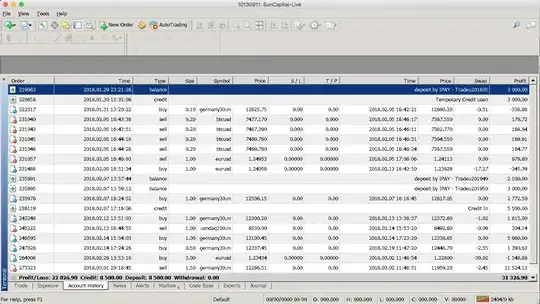

They told me that my platform would be connected to the main one, so I will automatically follow the manual trades opened by professional trader with 8 years experience in trading.

They've sounded very professional and authentic, so I've invested few thousand Euros to try, along with their 100% equity credit on top of it. While progress was promising (they've doubled the balance), in the next week, they've told me that they purchased some information on some trading exhibition, so they're 99% sure about the next deal, and since they've earned my trust, they've asked for another 5000 to lower the risk. They sounded convincing, so it happened along with their 100% equity credit.

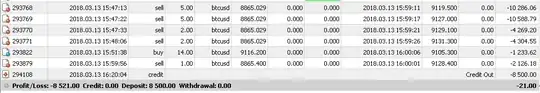

After 4 weeks, while keep updating me every few days about the great progress (without pressure), they've tripled my balance and earning my trust. However, now, they asking for another 20000 on top of it on their new big deal which I refused. This gave me the big red flag.

After searching, I've found one complaint on them online here, but it's not clear whether he just lost the money, also it doesn't confirm whether it's a scam, or not, and how it works.

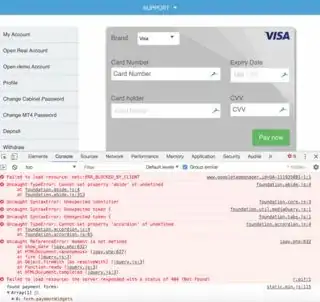

Their domain website is around 1 year old. It's not clear who owns it. Their certificate has been authorized by Let's Encrypt (related post).

My agreement reads that I can't withdraw within first 3 months, but they could be gone before then.

How can I tell whether they're scammers or not for sure? If they are, what would be the best approach to get my money back?