My snarky comment aside, there are many articles and studies that indicate that timing the market (waiting until a "correction") is not a good strategy. In fact, I cannot find a single one that claims that timing the market is a viable strategy (there are tons of Chicken Littles that push you to get out and invest in something "safer", like gold, but that's almost a constant and has nothing to do with the current market)

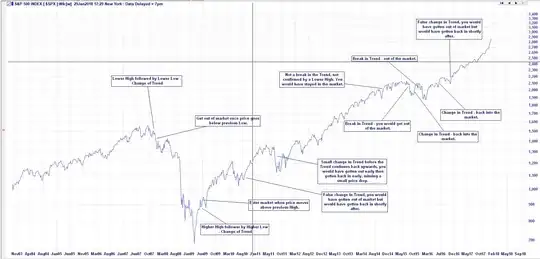

The problem is that you don't know when the market has reached its peak. Yes it's gone up and is at another all-time high, but it's also been climbing above its pre-2008 high for the last 5 years.

So yes, it seems to go against the "buy low, sell high" axiom, but the market overall goes up much more often than it goes down (26 of the past 31 years). Even if you bought at the pre-2008 S&P 500 high of roughly 1,500, today you would have a 91% overall gain. Granted if you had bought at the 2008 bottom you'd have a 272% gain, but you have no way of knowing what the bottom is to know when to get in.

In general, if you are investing for the short term and can't afford to lose, then equities are probably not best for you. You need something safer that will not crash (or at least something that won't crash as much, like bonds). If you are investing for longer periods (5, 10, 20 years) then at worst you might go through another correction and could have done better, but in the meantime you might also miss out on significant gains between now and then.

Another strategy is to diversify and rebalance periodically (e.g. quarterly). Buy a mix of classes (large-cap/small-cap/international/bond) and rebalance to keep a relatively consistent mix. The benefit here is you sell off some assets that have gains and buy some that might be lower, keeping the "buy low, sell high" mantra in effect).

pro