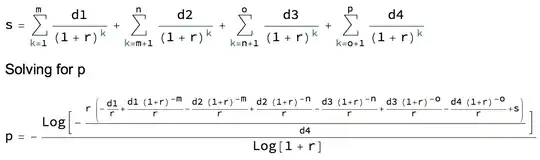

If you are increasing the repayment amount once part way through the loan term the calculations for total interest and term reduction are laid out here:

Extra Repayment loan calculator

Repeated changes to the repayment amount might be more simply calculated on a spreadsheet.

Further to downvote

I will leave this answer here for a while in case I get round to calculating a formula for multiple repayment amount changes. Otherwise the question will probably be closed. This happened before, while I was calculating. As it is this question already has 4 close votes. No idea why.

Example

Considering a loan where the payments are increased each year:

d1 = 2000

d2 = 2500

d3 = 3000

d4 = 3295.86

The principal is £100,000 and the interest rate is 1% per month.

s = 100000

r = 0.01

The payments are increased after 12, 24 and 36 months. When will the loan be paid down?

m = 12

n = 24

o = 36

p = ?

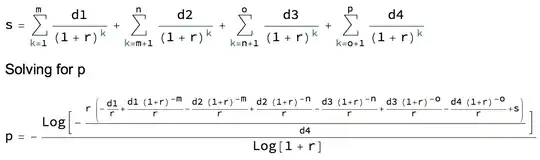

p = -(Log[-((r (-(d1/r) + (d1 (1 + r)^-m)/r - (d2 (1 + r)^-m)/r +

(d2 (1 + r)^-n)/r - (d3 (1 + r)^-n)/r + (d3 (1 + r)^-o)/r -

(d4 (1 + r)^-o)/r + s))/d4)]/Log[1 + r]) = 48 months

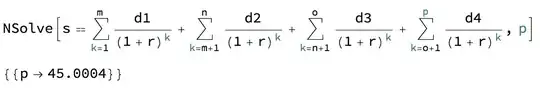

Now increase two of the payments

d2 = 2900

d3 = 3248

p = 45 months

The term of the loan is shortened by 3 months.

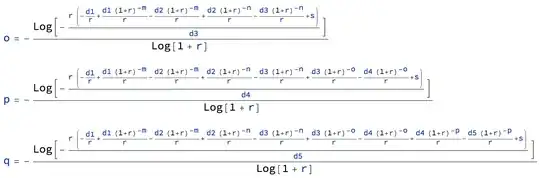

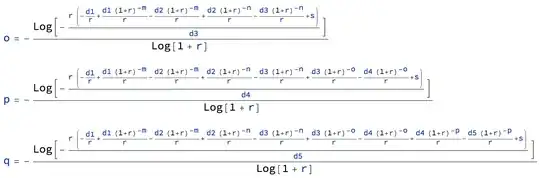

Comparing the formulae for loan terms with 3, 4 & 5 repayment changes, extending to o, p & q months, one can see how the general formula for any number of changes could be constructed.

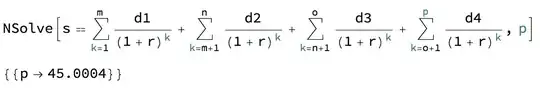

Of course, if you have a computer algebra program like Mathematica you can leave the calculation in the form of a summation, which makes the calculation as easy as it could be. Just add a new summation for each repayment change.

m = 12

n = 24

o = 36

s = 100000

r = 0.01

d1 = 2000

d2 = 2900

d3 = 3248

d4 = 3295.86