I recently received a letter from the IRS based on my taxes for 2015. I believe I did not understand the proper workings of a Roth IRA. I was under the impression I could pull my money out and only report any distribution increases on my taxes. For instance assume I had $1000 bucks in my Roth IRA. Let's say I only gained 10 bucks on it giving me $1010. I previously thought a Roth IRA allowed me to withdraw my original $1000 without any penalty but if I were to withdraw any gains and not report it on my taxes that would be wrong.

In any event, I only had around $10000 on a new Roth IRA and at the time I ran into some financial issues. I wasn't smart and had not saved in an emergency fund at the time (I know this was rather stupid of me considering I was putting in 15% of my salary in my 401k and putting money into my Roth IRA). I don't need tips or a lesson on how this is important - lesson was learned at the time.

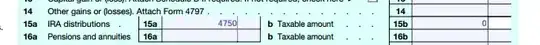

In any event in 2015 I had withdrew around $4750 of my own money (of which none of this had any gains) from my Roth IRA. I did not report this as income because I thought this was already taxed, already my money, and no gains.

So yesterday I got a letter from the IRS stating I owe $1950 back to them. Did I mess up? Was I supposed to report this as income? If I honestly messed up I will definitely pay it as I don't want to mess with the IRS and lesson learned. In other words if I can avoid this I'd like to but I am all for doing the right thing.

EDIT

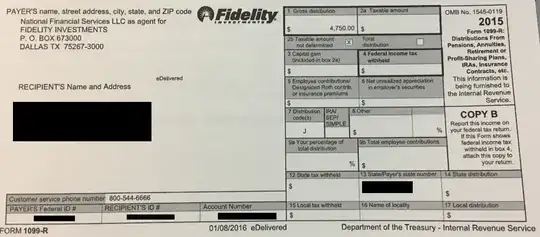

Back in 2015 when I first started doing my taxes I did not pay attention to form 1099-R. I was an idiot and learned from my mistake. I just went to fidelity's site and downloaded my 1099R and here is what it gave me:

I believe I did not put this value on my form. I am confused now who I need to contact or how I should fix this. Should I contact Fidelity or the IRS?