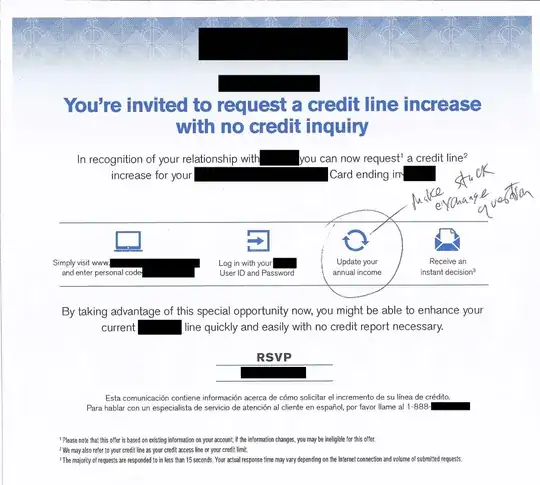

My bank has been hounding me to increase my credit line by updating my annual income. They must have some good flags to alert to such things since our spending has bumped a bit on the credit card, partly due to a salary bump, but partly do to trying to get more reward points. However we're always below 50% of the credit line for something like 11 months of the year at the least.

What are the pro's and con's of actually submitting this information to them? This question talks about marketing and demographic issues. What do credit card companies do with that information? And what's this no credit inquiry about? They basically make an internal decision without consulting any credit bureaus?