I find this very hard to believe

Believe it. The bottom quarter of American households have negative net worth, and the bottom three quarters have no more than a tiny amount saved up.

https://en.wikipedia.org/wiki/Wealth_in_the_United_States#/media/File:MeanNetWorth2007.png

In an emergency, 63% of Americans would not be able to come up with $500 without going into debt.

http://www.forbes.com/sites/maggiemcgrath/2016/01/06/63-of-americans-dont-have-enough-savings-to-cover-a-500-emergency/

Nobody can retire with 5k in the U.S. The money will be gone within a year. Is it possible?

Now you begin to see why the long-term stability of Social Security and Medicare are at present hot topics in American political life. Without them, a great many more Americans would die in poverty.

What is the actual figure?

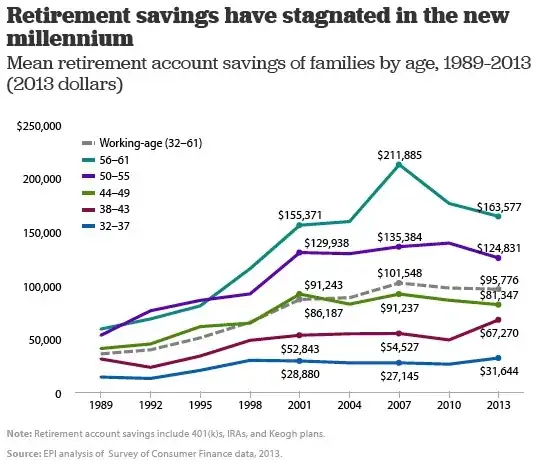

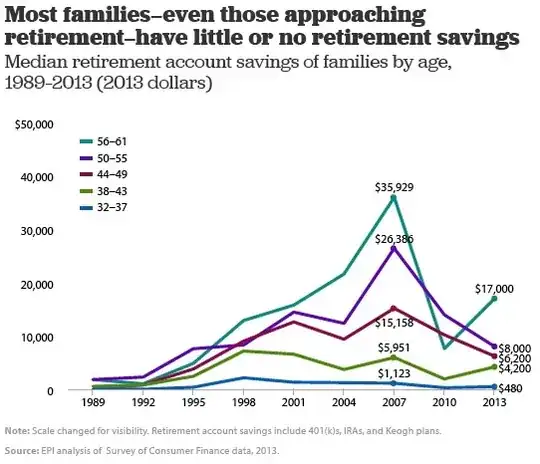

The $5000 figure is accurate but irrelevant; that median includes people who are thirty years from retirement and people who are two days from retirement.

The more relevant statistics are those restricted to people at or close to retirement age, and they can be found lower down in the article you cite, or in numerous other studies. Here's one from the GAO for example:

http://www.gao.gov/products/GAO-15-419

The figures here are, unfortunately, no less terrifying:

- 29% of retirement-age households have neither savings nor pension

- 23% have no savings but some kind of pension

- Of the 48% who do have savings, the median is in the range of $104K-$148K

Now $104K is a lot better than $5K, but it's still not much to retire on.

Why we believe that it is reasonable to throw out all the zeros before taking the median, I do not know. That seems like bad math to me.

UPDATE: There is some discussion of this point in the comments; all I'm saying here is that this is a clumsy and possibly misleading way to characterize the situation. The linked report has the actual data, but let's try to summarize it here in a more meaningful way.

Let's suppose that we make buckets for how dependent on SS is a retirement-age household to avoid starving to death, being homeless, and so on?

- $0 saved / totally dependent on SS: 41%

- some savings, but less than $100K saved / mostly dependent (interest on less than $100K is poverty level income): 28%

- $100K - $500K saved / somewhat dependent (interest on $100K-$500K approximately replaces an above-poverty income): 22%

- More than $500K saved: independent: 9%

Maybe these buckets are not ideal, and we could move them around a bit. The takeaways here are that the ratios of nothing:inadequate:barely adequate:comfortable is about 40:30:20:10. That only the top decile of retirement-age households can fund a comfortable retirement without help illustrates just how dependent on SS American households are.

how do 50% of old Americans survive in their old age?

Social Security and Medicare. As the cited GAO report indicates:

"Social Security provides most of the income for about half of households age 65 and older."

Do most old Americans rely on their children for financial support?

One day I met a woman at a party and we were making small talk about her kids. She had a couple already and one more was on the way. "I want to have lots of children to support me in my old age", she said. "Do you support your parents?" I asked, which frankly seemed like an entirely reasonable question. "Of course not! I can't afford it. I've got a baby on the way and two more kids at home!"

I left her to draw her own conclusions as to the viability of her retirement plan.

Nobody can retire with 5k in the U.S.I don't think this situation is unique to The United States. This is actually the case with most 1st & 2nd world countries. 5k is not really that much if you think about it. Factor in that the person with this money may not have any income at all... I doubt that they would even last 6-7 months (on 5k) in The United States let alone a whole year. – Dec 15 '16 at 18:26