To understand diversification, I highly recommend The Intelligent Asset Allocator. It walks through how diversification works starting with a practical example and then working through the math.

"Too diversified" doesn't really make sense based on what you're talking about. You might apply that description if you had a portfolio that was invested into a couple of dozen different asset classes and the complexity of managing it was becoming a burden. Of if you have so many asset classes that you incur extra costs that you can't recover through either higher return or reduced risk. (Beyond a handful of well-chosen asset classes, adding more diversification doesn't really buy you much extra risk reduction.)

Is this advisor fee-only or does he have a vested interest in getting you to buy something? If the latter, beware of advice given by salesmen...

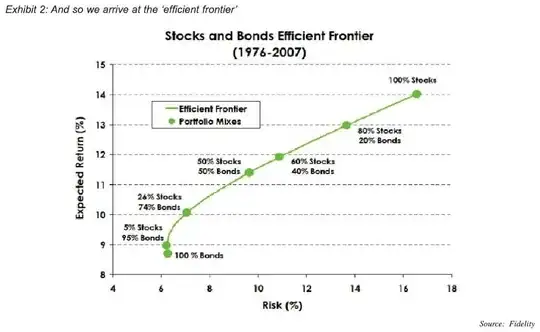

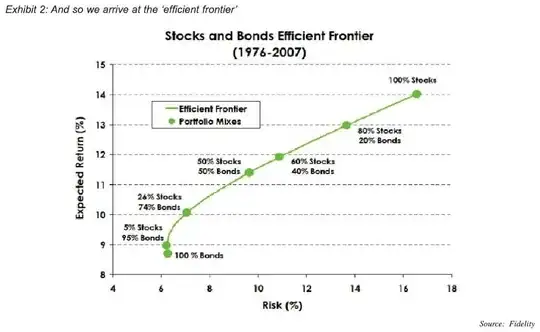

If you read the book, you'll be able to ask more intelligent questions of your advisor. But in any case, you should ask him to specifically explain why he thinks adding VTI or VEU will add more variance or lower expected returns to your portfolio than QQQ or SPY. Ideally, he can show you a pair of curves like this to back up his assertion -- one for VTI+VEU and one for QQQ+SPY: