What you can never do is try to add together payments made at different times. This defeats the whole principal of time value of money.

The trick here is to compare two car purchaser: #1 pays cash, and #2 pays the down payment, the regular lease payments, and the final buy-out amount. You need to find the interest rate to make these two payments schemes equivalent. But you must bring all payments to the same date, using the time value of money, and you need the interest rate to calculate the discounted value of the lease payments and the buy-out!

One answer is to use the "What-If" feature in Excel.

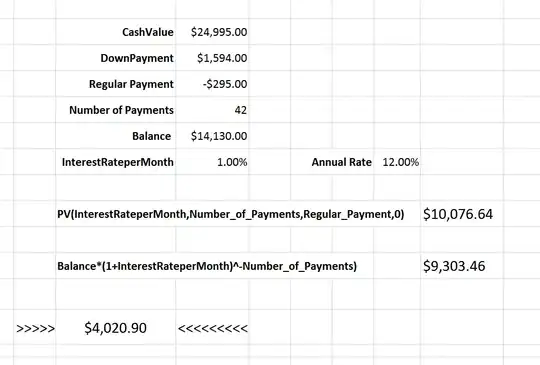

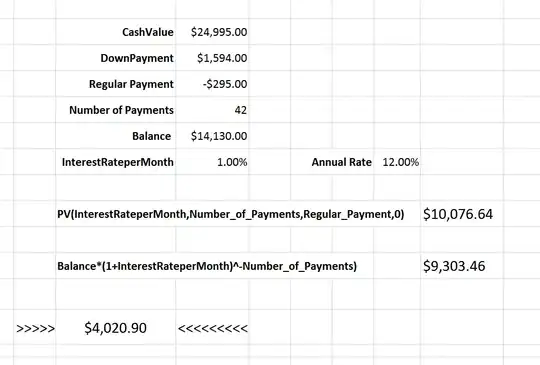

In this Excel screen grab:

I've entered the data from your loan along with some calculations.

The monthly interest rate is a wild guess, and the Annual rate is just that value multiplied by 12. The "PV" line is the present value (at the purchase date) of the regular payments, using that guess. The "Balance" line is the present value of the buy out discounted to 42 months earlier at that same guess rate. (Note the negative sign on the exponent).

The important value is between the two sets of chevrons (>>>>> <<<<<<<)

It represents the cash value minus (the down payment plus the Present Value plus the discounted buy out)

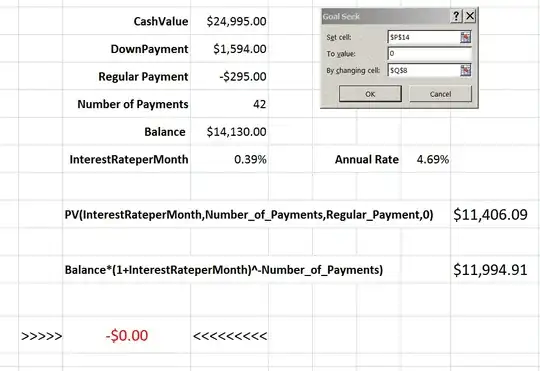

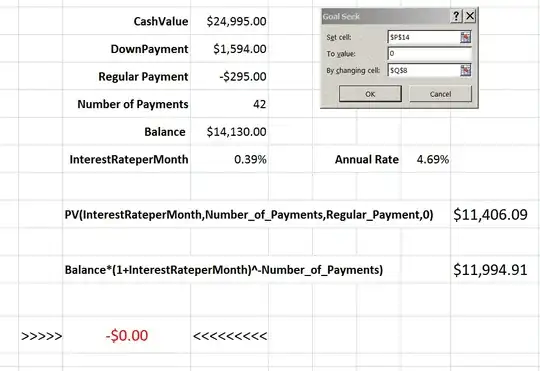

If the guess were correct, this value should be zero. It isn't so I could guess at different values for the monthly rate. But Excel will do it for me. If I select "Data / What If Analysis / Goal Seek", I get this screen:

In the Goal Seek window, I selected the chevron value to be zero by changing the interest rate, and clicked "OK" the results appeared in less than a second: the difference is zero, and the interest rate is changed to 0.39% per month, or 4.39% annually.