EDIT: the OUTSTAND_PRIN is the same as PRINCIPAL since I haven't begun paying down yet, but am saving like I am paying until my 6 months is up, just in case i need the extra $3,600 for an emergency beforehand.

Here is my situation: all of my student loans are through FAFSA and I want to pay them back as soon as possible. I'm thinking about my options here and I have an idea of going down two different routes.

1) 10 year plan with payments around ~$600/mo. Since I've budgeted for two paychecks/mo and I am paid bi-weekly, I plan on paying two extra checks, or around ~3,000/year, down on my loans. Additionally I'm thinking of upping my payment to $800/mo, and most likely higher after a year or so.

2) 25 year plan with payments around ~$323/mo. Here I would have lower monthly payments, hence more flexibility, in case an emergency came up. My thought process is to do the lower monthly payments and still pay ~$600-$800/mo down, same deal with the extra paychecks, and hopefully increasing my payment in a year or two.

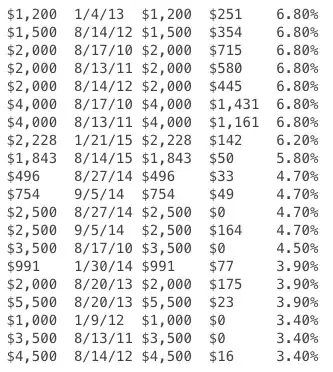

LN; PRINCIPAL; DATE; OUTSTAND_PRIN; INTEREST_ACCR; INT_RATE;

-------------------------------------------------------------------

1. SUB $3,500 08/17/2010 $3,500 $ 0 4.5%

2. UNSUB $2,000 08/17/2010 $2,000 $ 715 6.8%

3. UNSUB $4,000 08/17/2010 $4,000 $1,431 6.8%

4. SUB $3,500 08/13/2011 $3,500 $ 0 3.4%

5. UNSUB $2,000 08/13/2011 $2,000 $ 580 6.8%

6. UNSUB $4,000 08/13/2011 $4,000 $1,161 6.8%

7. SUB $1,000 01/09/2012 $1,000 $ 0 3.4%

8. SUB $4,500 08/14/2012 $4,500 $ 16 3.4%

9. UNSUB $2,000 08/14/2012 $2,000 $ 445 6.8%

10. UNSUB $1,500 08/14/2012 $1,500 $ 354 6.8%

11. UNSUB $1,200 01/04/2013 $1,200 $ 251 6.8%

12. SUB $5,500 08/20/2013 $5,500 $ 23 3.9%

13. UNSUB $2,000 08/20/2013 $2,000 $ 175 3.9%

14. UNSUB $ 991 01/30/2014 $ 991 $ 77 3.9%

15. SUB $2,500 08/27/2014 $2,500 $ 0 4.7%

16. UNSUB $ 496 08/27/2014 $ 496 $ 33 4.7%

17. UNSUB $ 754 09/05/2014 $ 754 $ 49 4.7%

18. UNSUB $2,500 09/05/2014 $2,500 $ 164 4.7%

19. UNSUB $2,228 01/21/2015 $2,228 $ 142 6.2%

20. UNSUB $1,843 08/14/2015 $1,843 $ 50 5.8%

- TOTAL LOAN BALANCE: $53,678

- TOTAL PRINIPAL: $48,012

- TOTAL INTEREST ACCRUED: $5,666

- WEIGHTED AVERAGE INT : 5.3%

My plan is to drop the payments to around ~$320/mo by switching to 25/yr plan and make these additional payments on to my principal, advising my federal loan servicer to pay me oldest, highest interest rate, loans first. This will pay off the loans that are accruing the most interest monthly first, and leave my room to drop down my payments for a few months if need be.

Does this sound like a viable plan? When I do an amortization table my answer comes out to be the same amount of interest paid, but it's not taking into account in which order it's being paid off in, but rather the extra payments being distributed evenly to all the loans. Is this the best way to tackle this? Not sure how to calculate it based on the order I'm paying off.

For this calculation could we assume I'm doing $800/mo in perpetuity.