Why do investors offset their annual returns against inflation, when inflation isn't realised until the end of the holding period (when the investor is actually spending the money)?

An example:

Assume the following:

- Stock with a 10% annualised return.

- Stock receives 50% of its growth from dividends - these are 'immediately' re-invested.

- Holding period is 50 years.

- Inflation is 3% per year.

Most people appear to calculate the inflation-adjusted return as:

Inflation Adj. Return = (1 + (0.10 - 0.03))^50 = 29.457

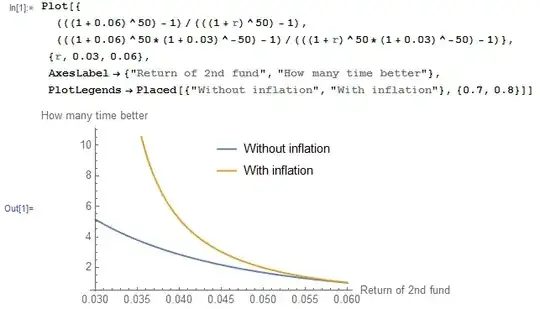

Another method, which makes more sense to me (with my current understanding), is as follows:

Nominal Return = (1 + 0.10)^50 = 117.391

Inflation = (1 - 0.03)^50 = 0.218

Inflation Adj. Return = 117.391 * 0.218 = 25.599

The results are very different.

Method 2 only realises inflation at the end of the holding period, but still accounts for the compounding effect against the dollar over time.

Method 2 also assumes "spending" your dividends by re-investing in the same stock is not affected by inflation. The rational is since you are purchasing the same "product" as the one you've just sold, so there's no realization of any loss or gain. There is, of course, some cash drag, brokerage fees and taxes - but no/minimal inflation (to my understanding).

Why is method 1 then used instead of method 2?

^50in the calculations - that's for the 50 year holding period. – Lawrence Wagerfield Dec 09 '15 at 15:48