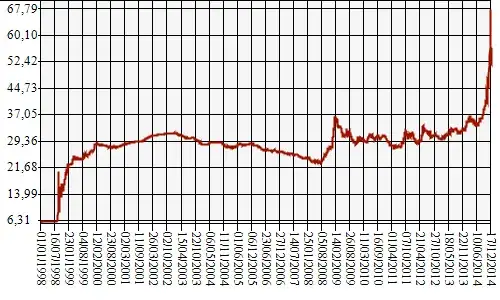

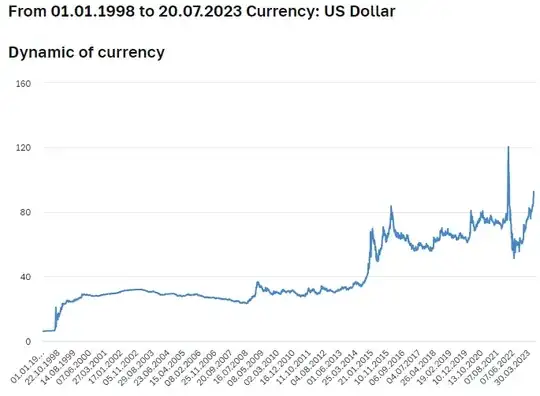

As everyone knows, the ruble is falling compared to the euro and it has been falling for a long time already.

The way I see it, the ruble will eventually get back up once the political situation around it is resolved. Is it naive to think I can just exchange - say, 500€ - for its equivalent in rubles, wait until the currency is back on its feet and then exchange it back now that it will return me more euros for the same amount of rubles?

For example, if I use €500 today and exchange it for rubles at today's rate (0.01349) I receive 37064.5 rubles (74.1290 * 500).

Taking the rate of about 2 years ago on March 12 2013, we see an exchange rate of 0.02500. That would mean I get €1 for every 40 rubles, resulting in a total of €926.6125 (37064.5 / 40).

Aside from the fact that you don't have access to your €500 in that period, is there any reason why someone shouldn't buy a cheap currency of an economy that's bound to bounce back?

Edit to address a common remark:

Isn't there a significant difference if you look at it from a short term vs a long term perspective? I would think that many companies with rubles step away from it so they don't endanger their operations with a shortage of money or being forced to lend more money (and as such incur interest rates).

Myself, on the other hand, can wait for years since it is "extra" money and I am not bound to the weak currency.

Does this lower currency rate really indicate that experts don't see much value in the ruble in the long term?