Options are a derivative product, and in this case, derive their value from an underlying security, a traded stock. An option gives you the right, but not the obligation, to buy a stock at a given price (the strike price) by a given time (the expiration date.) What I just described is a call option. The opposite instrument is a put, giving you the right, but not the obligation, to sell the stock at a given price.

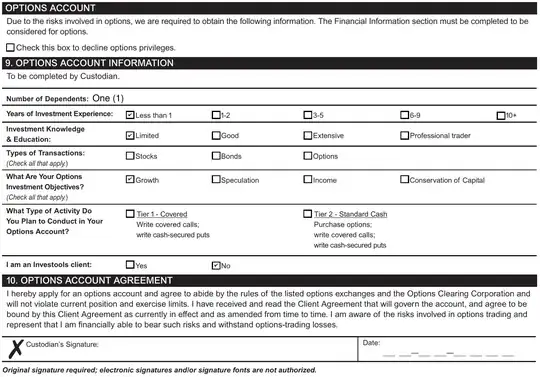

Volumes have been written on the subject, but I'd suggest that for a custodial Roth, I'd not activate the ability to trade options.

How to get started with options investing? offers a nice introduction to trading options. In my response, I offer an example of a trade that's actually less risky due to the option component.