You should be worried. You have made the mistake of entering an investment on the recommendation of family/friend. The last think you should do is make another mistake of just leaving it and hoping it will go up again.

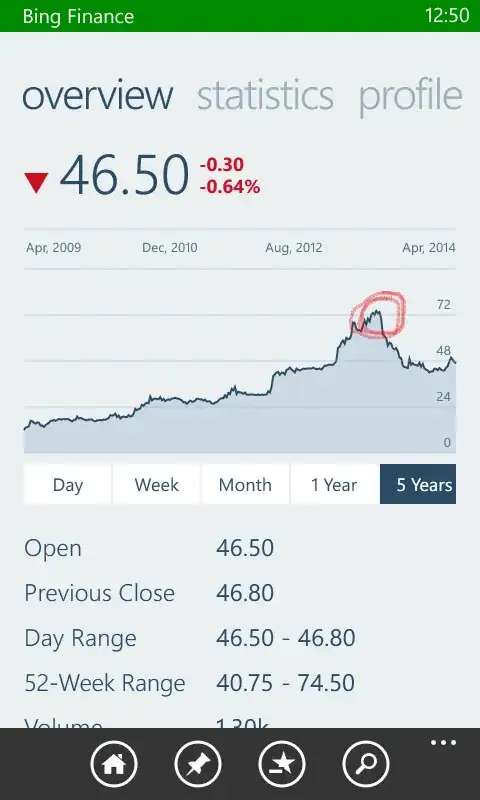

Your stock has dropped 37.6% from its high of $74.50. That means it has to go up over 60% just to reach the high of $74.50. You are correct this may never happen or if it does it could take a long, long time to get up to its previous highs.

What is the company doing to turn its fortunes around?

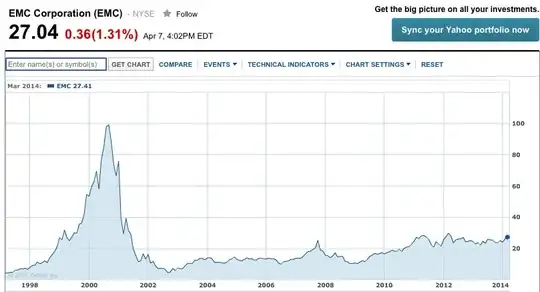

Take a look at some other examples:

QAN.AX - Qantas Airways

This stock reached a high of around $6 in late 2007 after a nice uptrend over a year and a half, it then dropped drastically at the start of the GFC, and has since kept falling and is now priced at just $1.15. QAN reported its first ever loss earlier this year, but its problems were evident much earlier.

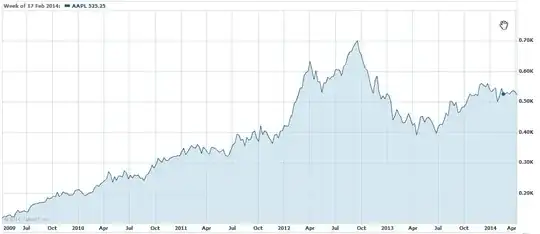

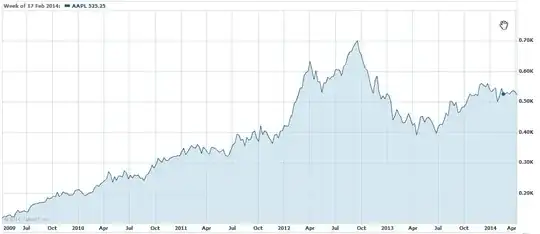

AAPL - Apple Inc.

AAPL reach a high of just over $700 in September 2013, then dropped to around $400 and has recovered a bit to about $525 (still 25% below its highs) and looks to be at the start of another downtrend. How long will it take AAPL to get back to $700, more than 33% from its current price?

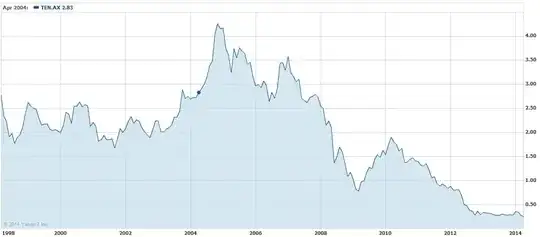

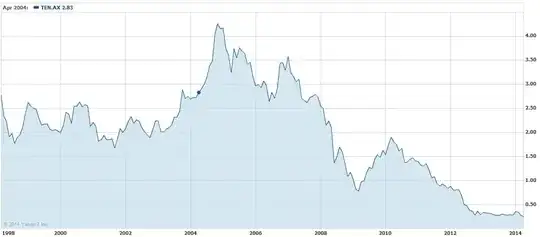

TEN.AX - Ten Network Holdings Limited

TEN reached a high of $4.26 in late 2004 after a nice uptrend during 2004. It then started a steep journey downwards and is still going down. It is now priced at just $0.25, a whopping 94% below its high. It will have to increase by 1600% just to reach its high of $4.26 (which I think will never happen).

Can a stock come back from a drastic downtrend? Yes it can. It doesn't always happen, but a company can turn around and can reach and even surpass it previous highs. The question is how and when will this happen? How long will you keep your capital tied up in a stock that is going nowhere and has every chance of going further down?

The most important thing with any investment is to protect your current capital. If you lose all your capital you cannot make any new investments until you build up more capital. That is why it is so important to have a risk management strategy and decide what is your get out point if things go against you before you get into any new investment. Have a stop loss.

I would get out of your investment before you lose more capital. If you had set a stop loss at 20% off the stock's last highs, you would have gotten out at about $59.60, 28% higher than the current share price of $46.50.

If you do further analysis on this company and find that it is improving its prospects and the stock price breaks up through its current ranging band, then you can always buy back in. However, do you still want to be in the stock if it breaks the range band on the downside? In this case who knows how low it can continue to go.

N.B. This is my opinion, as others would have theirs, and what I would do in your current situation with this stock.