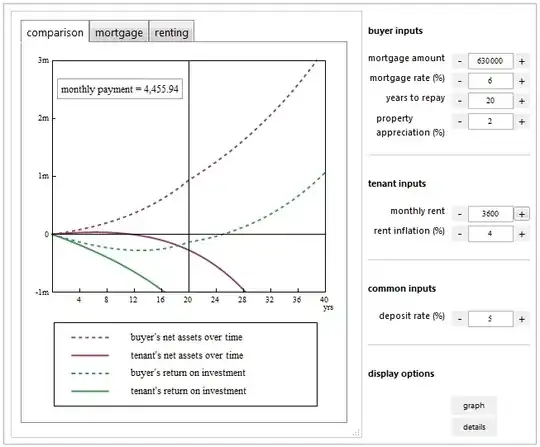

Option A: $3600 (RENT) for a 3/2.5 condo.

Option B: $629,000 (BUY) for a 3/1.75 house.

This is in the Los Angeles area.

Looking to live in this area for at least a year, maybe more. The house wouldn't be something we'd live in for 20 years or anything, but we could live there a few years then rent it out or sell.

According to my calculations:

1 year of rent = $43,200

1 year of owning = $25,000 in mortgage payments + $7800 taxes = $33,000 total.

Assuming we put 20% down on the purchase option.

So it seems like buying is the better option right? Saves $10,000 over the first year, and that doesn't even count any equity. It's just more risky - I guess the market could always take another dive and we'd lose money.

Is there anything else we should be thinking about? Any advice? Assume we like both properties equally.

Is there anything you do/can invest your deposit in that will get a similar or better return? It almost sounds like you have your answer already.

– sdgenxr Mar 31 '14 at 02:55