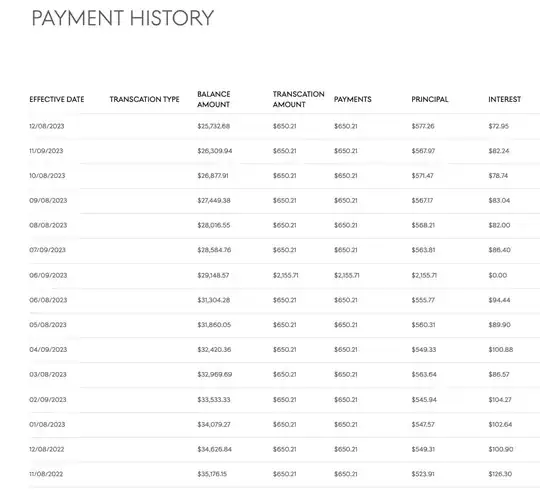

Car loans and other retail loans often use an ACT/ACT or ACT/365 day count where interest is charged based on the number of days between payments rather than a flat 1/12 of the annualized rate (which is more common for mortgages and other longer-term loans) each month. You'll notice that payments after months with 31 days have a slightly higher interest amount than those with 30 days, and the March payment has a noticeably lower interest amount. There is also some fluctuation since the payments are not always applied on the same day of the month (e.g. the 2/9/2023 payment includes one more day than the 1/8/2023 payment)

The interest is calculated as a percentage of the prior balance. For example, the interest amount for 12/8/2022 looks to be be 35,176.15 * 3.5% * (30/366) where 30 is the # of days between 11/8/2022 and 12/8/2022. It's not clear why 366 is used instead of 365 but that is what matches the result most closely (and works in your favor).

Some loans will count only business days (and divide by some number around 252), not calendar days, but generally these differences are not material to you, it just makes the settlement and accounting easier on their end.

There is still a downward trend as you pay down principal, but you won't necessarily see every month's interest

lower than the one before.

Could someone please offer guidance on what steps I should take next?

Pay it down as fast as possible? That will reduce the interest paid significantly (as can be seen after the "extra" payment in June). In the end the fluctuations based on day count will even out, so there's not really anything to "do".