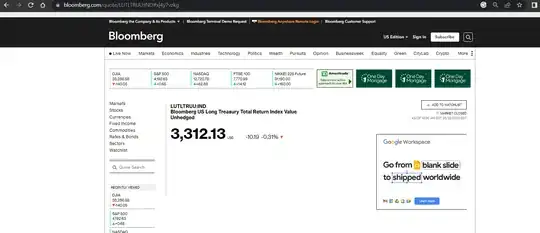

I have purchased shares of a bond ETF, ticker symbol: SPTL (SPDR Portfolio Long-Term Treasury ETF). The prospectus states: "the fund's goal is to track the total return of an index that measures the performance of the long-term U.S. Treasury bond market (the Bloomberg US Treasury Long-term TR index)". I have wondered what exactly "the performance" means. I understand the Total return index also counts the coupon returns; but, basically, does "performance" here mean the average price of the long-term Treasury bonds included in the index?

As far as I know, the S&P 500 tracks the total market cap of 500 companies included in the index. However, I downloaded the Bloomberg Barclays Bond Indices Methodology booklet, and have read it. But, because they are total return indices, the formulas are too complicated for me to understand.