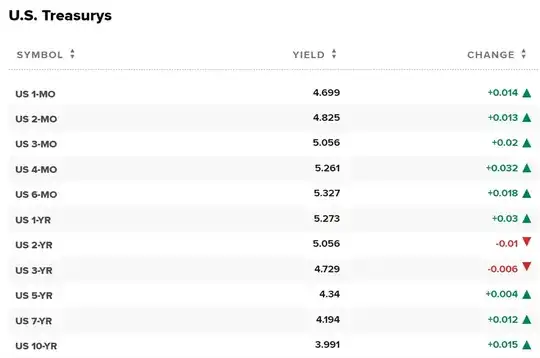

If US Treasuries at yielding 4-5% right now, why can't I find a 1 month US Bond ETF or 6 month US Bond ETF that yields 4-5%? The best I can find is SGOV but it only yields 2%.

Asked

Active

Viewed 5,828 times

24

Chris W. Rea

- 31,671

- 16

- 102

- 190

Katsu

- 515

- 3

- 10

3 Answers

12

The average yield to maturity of SGOV is 4.41%. The 2% is the 12-month trailing yield. From https://www.ishares.com/us/products/314116/ishares-0-3-month-treasury-bond-etf:

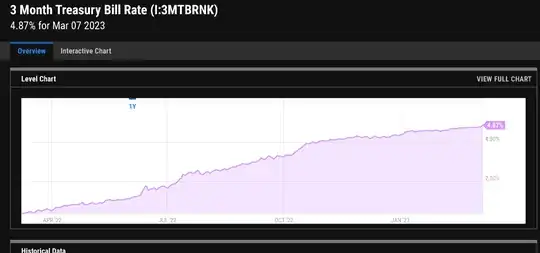

Note that the average yield to maturity of SGOV is a bit lower than newly issued Treasury bills, as the yield to maturity has been increasing steadily over the past 1 year. From https://ycharts.com/indicators/3_month_t_bill:

Franck Dernoncourt

- 11,317

- 11

- 52

- 129

-

Do you have a recommendation for an ETF that is more closely tied to the actual 3 month yield than SGOV? – Katsu Mar 09 '23 at 18:43

-

This might be its own question, but the way these ETFs work, would you expect the minimal return to be at least the the minimum yield of 0-3 month treasuries during the previous 12 week period? Since theoretically every treasury has rolled over at that point? – Chuu Mar 10 '23 at 16:00

-

I think you'd just look at the ETF's avg effective duration and look at the yield based on that. Open to being corrected on that. – Katsu Mar 10 '23 at 18:08

-

0

If you're trying to immediately capitalize on higher rates, your best bet might actually be a money-market mutual fund in the current environment. These funds have access to the Fed's Overnight Reverse Repo ("ONRRP") facility for parking their excess cash, and as of the most recent rate hike, the ONRRP facility is paying 5.30%.

user68318

- 364

- 10

<code>HTML tags, meaning that if you're using a screen reader or other accessibility software, it's going to treat things formatted in that way as code, not formatted text. It's an accessibility issue to use them as generic formatting. – Chris Hayes Mar 10 '23 at 00:07