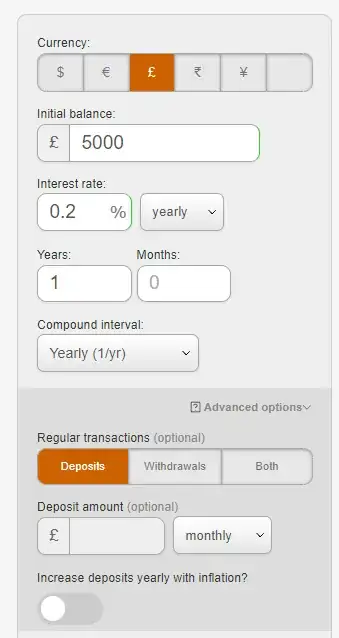

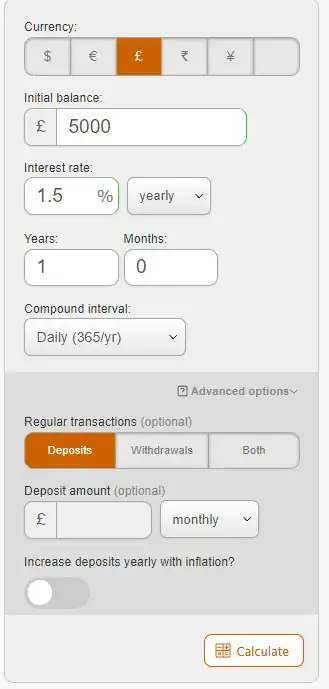

So, Chase has a savings account for 1.5%. They calculate the 1.5% AER (1.49% gross) variable interest daily and pay it monthly. Lloyds, on the other had 0.20% gross interest (no more info given in the app though).

So, for an amount of 5000 the Chase will pay: (1.5%/365)500030 = 6.16438356164 pounds per month

and Lloyds 0.2%*5000= 10 ?

Am I missing something here? According to that, something is not right to me: https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php