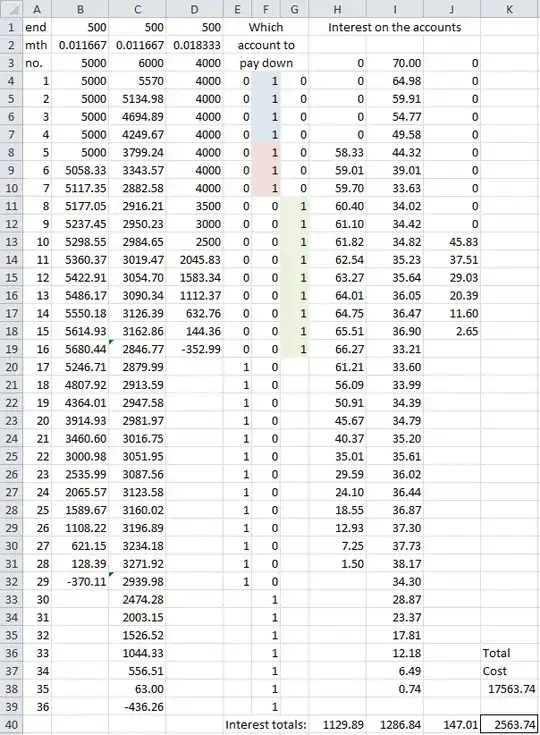

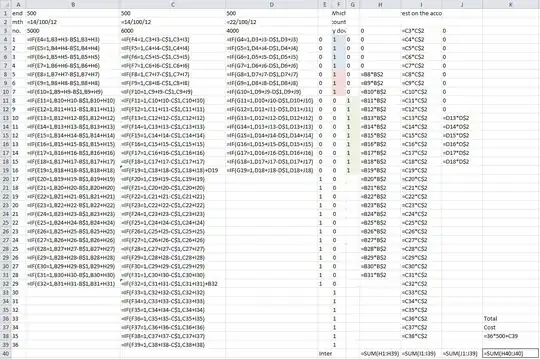

So I'm in not-the-best™ position with about 15K in undesirable credit card debt (And another 5K in permanent no-interest deferred payment plans). I'm trying to calculate what the optimal payoff strategy is, but I'm coming up confused. Here's a brief overview of the amounts and approximate interest rates:

- Acct 1: 5K, 0% for 5 months, then 14%

- Acct 2: 6K, 14%

- Acct 3: 4K, 0% for 10 months, then 22%

Obviously, if I didn't have the 0%, it would make the most sense to pay off the 22% first. That said, I'm currently able to make between $300-$500 payments every month to any one of these cards, above the minimums. The question is, what's the optimal strategy? 14% on Acct 2 is currently the highest, but then again, the 22% on Acct 3 will be highest after the intro period. I'm not sure how to do the math on these, or what to plug in to excel. I'm hoping someone will be able to post a good enough answer that I can solve this problem myself using excel or a pocket calculator.