I was talking to our financial advisor recently and he mentioned we could earn some 2% more, on the long term, if we invest on a monthly basis rather than, say, when a yearly bonus arrives. It would also alleviate time-of-entry issues.

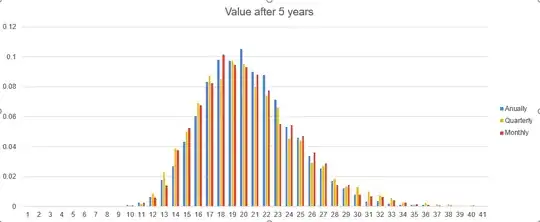

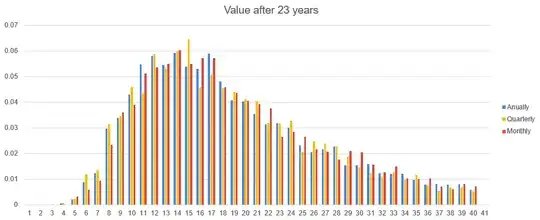

In a simple spreadsheet working with average returns the more frequent the investments the higher the returns it seems. So, if we could invest on a daily basis or even more frequently, the returns would be seemingly higher compared to less frequent investments in the same instrument.

But then I fired up a Jupyter Notebook to see what would happen to a population of investors following different frequency strategies with actual fund data.

Specifically, I used daily historical data from a few funds and I asked myself: what happened to the an investor who invested on a yearly basis in the fund for, say, 8 years, starting from the very first day available in the data? And what happened to an investors investing for the same amount of time, with the same strategy but starting one day later? And so on, shifting the window one day at the time, for as long as the data allows?

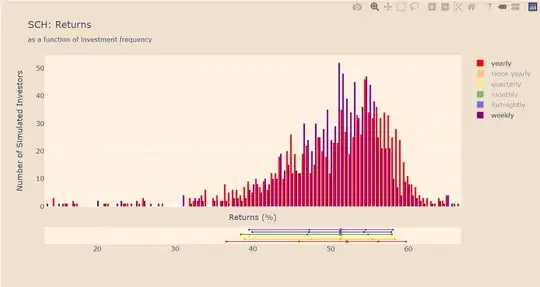

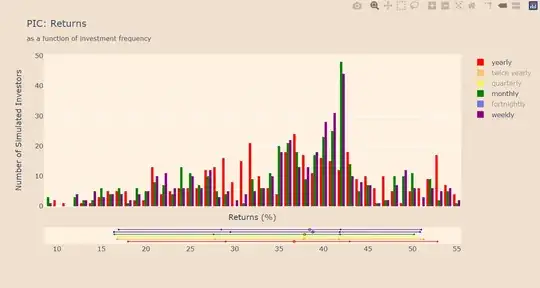

Then I repeated the same process with different frequencies - investing every 1, 3, 6 months and every 1 or 2 weeks. I finally pooled each population of investors into histograms and, more synthetically, into the 5, 25, 50, 75 and 95 percentile bars that you can see in these images:

The results were not what I expected. I see little difference between the distribution of returns.

The first fund (SCH) seems to somewhat confirm the hypothesis that investing more frequently reduces the spread of the outcomes - the outcomes at the 5 and 95 percentile points are closer together. But the weekly and twice-yearly frequency seem to result in the same spread of outcomes. And the fortnightly investment frequency seems to have an even tighter spread of outcomes than the weekly. Then the median of the outcomes is marginally better with the yearly frequency while the other medians are nearly identical.

The second fund (PIC) shows a nice trend on the median outcomes, with the median outcome of a weekly investment schedule being up to 4% higher than the median outcome of a yearly investment schedule. But there seem to be counterintuitive trends or no trends at all when we look at the other percentile points: there seem to be no correlation or very marginal correlation between outcomes and frequency of investment at these points. Similarly, investing more frequently doesn't seem to reduce the spread of outcomes in this case.

Hence the questions:

- is my methodology (uniformly sampling the data and creating a population of outcomes) reasonably valid for investigating the relation between outcomes and frequency of investment?

- has anybody made a similar (or radically different!) type of analysis on this subject and can confirm a low correlation between long term investment frequency in an instrument and outcomes?

In case somebody wants to play with the data from the funds, the chart section of the two links above provide historical daily data in csv format.