TL/DR:

- Basing your life on current tax law is foolish. Tax laws will change.

- Personal finance is largely about emotions and behavior: math plays less of a role than one might think.

- Seeing a lawyer for common transactions might encourage one to marry just to avoid using a lawyer.

Your question also represents the misunderstanding that much of personal finance is about math; it is also about behaviors and emotions. We marry for a lot of reasons, and many of them have nothing to do with math. Tradition, religious beliefs, treatment by others all play into it. For example, some women want a Tiffany ring for their engagement. They could have larger diamonds for less money by buying an off-brand that only a select few can differentiate, but that is what they want. The whole thought and purchase of rings plays into your question but also provides a bit of an answer.

The thought of involving lawyers in my financial affairs would probably lead me to marriage anyway. Dealing with lawyers is expensive, time consuming, and they often make mistakes. Buying a home is stressful as is. Adding another layer onto that may lead a person to marriage despite any tax inefficiency.

Also, this site is full of questions regarding tales of woe where unmarried partners bought assets without involving lawyers. Every significant purchase including cars would require the intervention of a lawyer. No thank you.

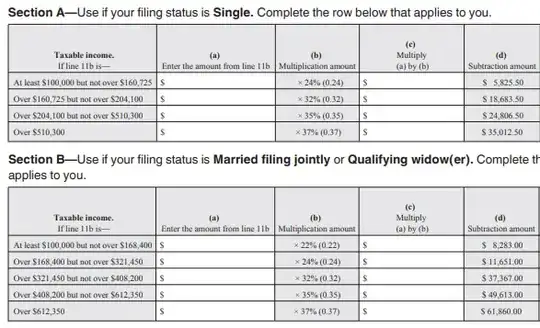

The new tax laws may have also made your question not applicable. In 2020 only individuals who make more than $518,401 that also have a spouse that makes more than $103,650 experience some tax inefficiency. That inefficiency is experienced on each dollar earned above those numbers. So, if a wife earns $520k/year and her husband $110K, they would pay about $167 more in taxes per year than if they remained single. That is not to say tax laws will not change in the future, but that is a point to consider. Basing life decisions on current tax law is a bit foolish as it will change. It should be noted that very few households will fall into this income category.

Some high-income couples actually benefit mathematically from being married. For example, in some locations, obstetricians put all their assets in their spouses' names and do not carry malpractice insurance. The insurance is so expensive, and the frequency of successful lawsuits so common, that this is the best practice. When a dead or injured child is involved, the plaintiffs will be awarded some money regardless of liability.