About me:

I make about $3330 a month from my job after taxes.

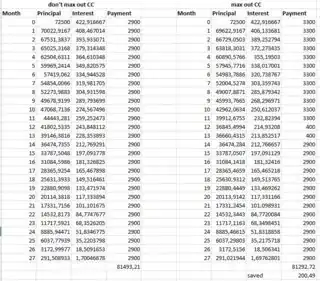

I'm currently $72,500 in debt from student loans, 7% APR. I have 0 other forms of debt (I live with my parents and bought a used car for cash).

I spend about $300-$400 a month on myself on a credit card, and pay it off monthly. The rest of my paychecks go straight into my loan debt.

I just got approved for the Chase Freedom card, because I wanted the $200 signup bonus to put towards my debt. I noticed after applying that I'll accrue 0 interest on it for the first 15 months as part of their 0% APR promotion.

So here is my question: Would it make sense to stop paying down my credit card balance every month, and instead put my full paycheck (except the minimum card payment) into the loan debt? In about 12 months, I would focus all my pay on the Chase card so I never pay CC interest, then go back to what I currently do, but now with reduced interest gain on the student loans. I'm considering this because that 7% is making my debt over $400 larger every month.

Putting the credit card debt off for 12 months would allow me to put around $4800 extra into my debt, which I can pay off of the card in two months. In those two months, my loan debt will gain interest a decent amount slower than it currently does.

Does it make sense to do this or am I deluding myself? I'm not sure if I have the math right but I'd like to take advantage of 0% CC interest for 15 months if there's a good way to do it. Thanks!

Edit: Someone changed my title to make the post misleading, and people just skimmed the title and didn't read the rest of the post before replying. To reiterate: I would not be gaining interest on the CC balance for 15 months due to the Chase promotion.

Also, I'm putting about $3000 into the loan debt every month. Because of the interest, it grows $400 more, so my $3000 is really worth $2600, which is what inspired this post. Sorry for any confusion there.

nmonths" offers are conditional: it's only valid so long as you pay off your balance in full each month (which, yes, makes such an offer useless anyway). If you go even a single month without paying off your balance (certainly if you don't pay anything), you usually get immediately bumped up to the penalty APR rate which is typically >= 20%. So, make sure you read the fine print. – TylerH Feb 04 '20 at 19:55nmonths (I forget how many months it was. Somewhere between 12 and 18) so long as you pay your balance off in full each month. I asked them what the point of it was since it would be 0% interest regardless of what the rate was if I paid it off in full each month but didn't get a satisfactory answer from them. But it was in fine print on the form I was filling out, otherwise I would not have bothered to ask. – TylerH Feb 04 '20 at 20:27