How do I calculate the balloon payment on a 30 year mortgage with an APR of 7.8%, where the balloon payment must be made after 8 years.

2 Answers

There are a lot of mortgage balloon calculators on the Internet. But we can calculate it without them.

From this Mortgage Professor page:

The following formula is used to calculate the fixed monthly payment (P) required to fully amortize a loan of L dollars over a term of n months at a monthly interest rate of c. [If the quoted rate is 6%, for example, c is .06/12 or .005].

P = L[c(1 + c)n]/[(1 + c)n - 1]

Your interest rate is 7.8%, so c=0.078/12, or 0.0065. You didn't provide a loan amount (L), so let's use L=$100,000. A 30-year mortgage means that n=360.

Putting that all together give us a monthly payment of $719.87.

From the same site:

The next formula is used to calculate the remaining loan balance (B) of a fixed payment loan after p months.

B = L[(1 + c)n - (1 + c)p]/[(1 + c)n - 1]

Putting in your values (L=100,000, c=0.065, n=360, p=95), we end up with B=$90,856.80.

So, you'll have 95† monthly payments of $719,87, with a remaining balance of $90,856.80. If you wait one more month to pay it off, you'll accrue one more month of interest, so the balloon payment amount will be 90,856.80*(1+0.0065) = $91,447.37.

†Depending on the exact date of the balloon payment, you might have made 95 payments or you might have made 96. It depends on the precise meaning of "after eight years".

- 1,341

- 7

- 9

Using the method shown in this link.

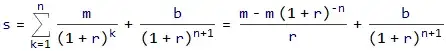

The value of the loan is equal to the sum of the discounted values of the repayments.

∴ b = ((1 + r) (m + (1 + r)^n (r s - m)))/r

where

s = present value of loan

m = periodic repayment

r = periodic rate

b = balloon payment

n = number of periods (or payments) before the balloon payment

First calculating the repayment amount m for a 30 year loan, assuming principal of 100,000, monthly repayments and APR as a nominal rate, compounded monthly.

s = 100000

r = 7.8/100/12

n = 12*30 = 360

m = r (1 + 1/((1 + r)^n - 1)) s = 719.87

If the balloon is to be paid at the end of the 96th month

n = 8*12 - 1 = 95

b = ((1 + r) (m + (1 + r)^n (r s - m)))/r = 91447.37

- 9,797

- 1

- 20

- 36

90856.80 (1 + c) = 91447.37paid in month 96? – Chris Degnen Mar 24 '19 at 23:26