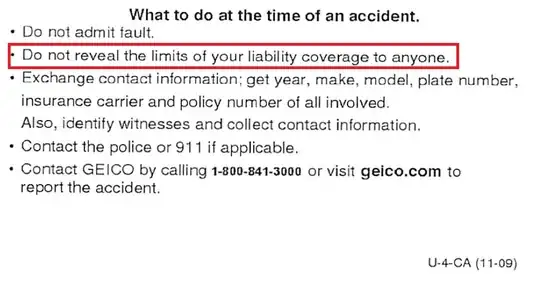

The limits of your coverage are completely irrelevant to anything you might do in a situation where your liability coverage is in play. More directly, there is nothing at all for you to gain from providing this information. Another way to look at the question is "why would you want to reveal this information?".

There probably isn't much downside to it for you, personally. Your insurer will be on the hook for any negative consequences (like inflated settlement amounts, at the margins), but your policy isn't going to retroactively change or anything. But the insurer will still want to protect its own interests to the maximum possible extent.

Your contract almost certainly establishes that every element of the settlement, and negotiations around it, will be handled by your insurer. You blurting out information in this situation wouldn't be much better than you interrupting your own lawyer in the courtroom during arguments in a trial.

As a few examples:

- Someone might see your volunteering that information as an admission

of guilt, giving them much better leverage in negotiations than if

you'd simply not said anything.

- The payment sought might become higher due to knowing how much money

is "available", as per other answers here.

- It's not that hard to rack up "valid" medical charges, meaning not

obviously fraudulent, like additional MRI scans because the ones

already done aren't clear enough (allegedly). This is somewhat risky (the claim may not cover those bills anyways), but it is less risky if the potential insurance payout has a higher ceiling.

- The other party (or parties) might believe that they are entitled to

that amount of money, not for any rational reason but because it's the number they heard, and then becomes hard to deal with within and

outside of the insurance process.

- It might simply make the settlement process longer and more tedious,

causing the insurer's money to be burned in extra administrative and

bureaucratic costs to no additional benefit to anyone. Consider the case of identifying which medical bills were reasonable and which were opportunistically grasping for more cash-- that audit isn't free.

- Revealing information about your policy might suggest information

about your personal financial situation, making you a target for

additional civil litigations (whether they are frivolous or not,

you'll have to dedicate time, energy, and money to responding).